US Airways 2006 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

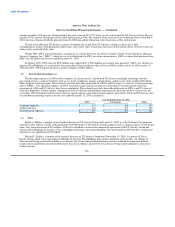

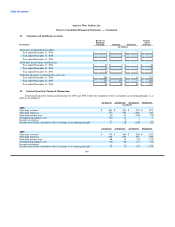

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

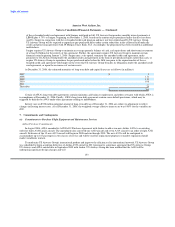

a US Airways credit card, as well as unspecified damages. On October 27, 2005, Juniper, which was not originally a party to the lawsuit,

sought and later received court permission to intervene as a defendant in the case and has made counterclaims against Bank of America.

Juniper seeks an order declaring the validity of its new agreement to issue a US Airways frequent flyer credit card. On November 3,

2005, Bank of America filed a motion for partial summary judgment on the breach of contract claim against US Airways. After a series

of procedural steps, Bank of America's motion, along with a cross-motion for summary judgment filed by Juniper, was heard in the

Bankruptcy Court, where the case is now pending as an adversary proceeding. On January 30, 2006, the Bankruptcy Court ruled that

Bank of America was equitably estopped from pursuing its claims that US Airways breached its agreement with Bank of America by

negotiating and entering into the agreement with Juniper. The Bankruptcy Court ruled in the alternative that US Airways did not breach

its agreement with Bank of America to be the exclusive card issuer, but that US Airways had breached the "no shop" provision of the

Bank of America agreement when US Airways negotiated with Juniper prior to reaching the Juniper agreement. Bank of America sought

appeal of that ruling while it has continued to pursue certain administrative claims against US Airways in the Bankruptcy Court. The

resolution of the final two claims that Bank of America made in the lawsuit, which are (i) that AWA tortiously interfered with the

contractual relationship between US Airways and Bank of America and (ii) that US Airways Group and AWA tortiously interfered with

Bank of America's right to future economic benefit under its agreement with US Airways, are dependent on the outcome of the pending

appeal. Bank of America will pursue those two claims only if its appeal of the January 30, 2006 order is ultimately successful. On

July 19, 2006, the Eastern District of Virginia affirmed the Bankruptcy Court's order in part, ruling that US Airways did not breach the

exclusivity provisions of the contract. However, the Eastern District of Virginia reversed the Bankruptcy Court's decision on equitable

estoppel and remanded the remainder of the case to the Bankruptcy Court to take further evidence. Bank of America and US Airways

have each appealed the July 19, 2006 ruling. On January 16, 2007, Bank of America amended its complaint to add additional breach of

contract and tortious interference claims against US Airways and AWA, as well as claims against Juniper.

AWA is unable to estimate at this time the amount of loss or probable losses, if any, that might result from an adverse resolution of

the proceedings discussed above, and currently is unable to predict whether the outcome of these proceedings will have a material

adverse effect on its results of operations or financial condition. AWA intends, however, to vigorously pursue all available defenses and

claims in these matters.

(e) Guarantees and Indemnifications

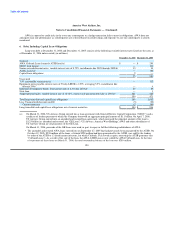

In June 1999, Series 1999 special facility revenue bonds ("new bonds") were issued by a municipality to fund the retirement of the

Series 1994A bonds ("old bonds") and the construction of a new concourse with 14 gates at Terminal 4 in Phoenix Sky Harbor

International Airport in support of AWA's strategic growth plan. The new bonds are due June 2019 with interest accruing at 6.25% per

annum payable semiannually on June 1 and December 1, commencing on December 1, 1999. The new bonds are subject to optional

redemption prior to the maturity date on or after June 1, 2009 in whole or in part, on any interest payment date at the following

redemption prices: 101% on June 1 or December 1, 2009; 100.5% on June 1 or December 1, 2010; and 100% on June 1, 2011 and

thereafter. In accordance with EITF Issue No. 97-10, "The Effect of Lessee Involvement in Asset Construction," AWA accounts for its

payments under this financing facility as an operating lease.

In connection with the new bonds, AWA entered into an Amended and Restated Airport Use Agreement, pursuant to which AWA

agreed to make sufficient payments to the Phoenix Industrial Development Authority ("IDA") to cover the principal and interest of the

bonds and to indemnify the IDA for any claims arising out of the issuance and sale of the bonds and the use and occupancy of the

concourses financed by the new bonds and the old bonds. At December 31, 2006, the outstanding principal amount of the bonds was

$22 million. AWA estimates its remaining payments to cover the principal and interest of these bonds will be approximately $39 million.

156