US Airways 2006 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

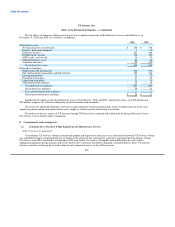

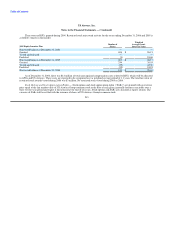

US Airways attributes operating revenues by geographic region based upon the origin and destination of each flight segment.

US Airways' tangible assets consist primarily of flight equipment, which are mobile across geographic markets and, therefore, have not

been allocated.

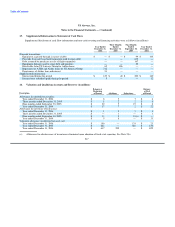

14. Stock-based Compensation

The Predecessor Company recorded stock-based employee compensation in accordance with SFAS 123 during the year ended

December 31, 2004 and during 2005 until the merger. Effective with the merger on September 27, 2005, US Airways applied the

provisions of APB 25 and related interpretations. Effective January 1, 2006, US Airways adopted SFAS 123R, using the modified

prospective transition method. Under the modified prospective transition method, compensation cost is recognized in the financial

statements beginning with the effective date, based on the requirements of SFAS 123R for all share-based payments granted after that

date, and based on the requirements of SFAS 123 for all unvested awards granted prior to the effective date of SFAS 123R. Results for

prior periods are not restated using the modified prospective transition method.

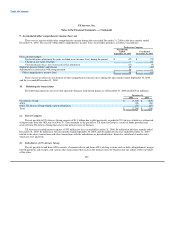

(a) Predecessor Company

Upon confirmation of the Plan of Reorganization, existing shares of US Airways Group's common stock were cancelled. The Plan

of Reorganization resulted in holders of US Airways Group's common stock and related equity securities receiving no distribution on

account of their interest.

Prior to cancellation of the shares of US Airways Group's common stock upon emergence from bankruptcy on September 27, 2005,

there were 4,750,000 shares of US Airways Group Class A Common Stock and 2,220,570 each of Class A-1 Warrants and shares of

Class A Preferred Stock authorized to be granted to US Airways' management. Through September 27, 2005, 3,649,159 shares of

US Airways Group Class A Common Stock, 2,101,240 each of Class A-1 Warrants and shares of Class A Preferred Stock, and 354,350

options to purchase Class A Common Stock were granted to US Airways' management. Grants of Class A Common Stock, stock options

and warrants generally vested over four years. The Predecessor Company recorded compensation expense over the vesting period. The

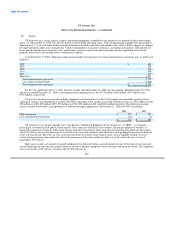

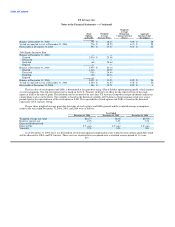

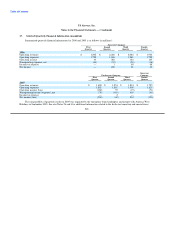

following table summarizes the activity of the Predecessor Company's stock options and warrants granted since emergence from the first

bankruptcy through cancellation of those shares upon emergence from the second bankruptcy:

Weighted Weighted

Stock Avg. Avg.

Options Exercise Price Warrants Exercise Price

Balance at 12/31/03 — — 2,216,526 7.42

Granted 466,640 1.53 49,200 7.42

Canceled (109,250) 1.51 (147,236) 7.42

Balance at 12/31/04 357,390 1.54 2,118,490 7.42

Granted — — — —

Canceled (357,390) 1.57 (2,118,490) 7.42

Balance at 9/27/05 — $ — — $ —

There were no stock options or warrants granted during the nine months ended September 30, 2005. The weighted average fair

value of stock options and warrants granted during the year ended December 31, 2004 was $0.80 and $2.70, respectively.

US Airways Group did not grant any shares of restricted stock during the nine months ended September 30, 2005. US Airways

Group granted 835,160 shares of restricted Class A Common Stock during the year ended December 31, 2004. There were 1,683,674

non-vested shares of restricted stock outstanding immediately prior to cancellation upon emergence from the second bankruptcy on

September 27, 2005.

210