US Airways 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

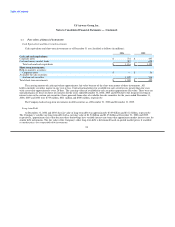

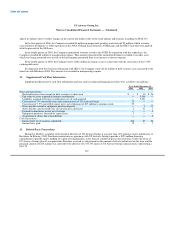

The weighted average asset allocation as of December 31 by asset category is as follows:

2006 2005

Equity securities 70% 68%

Debt securities 25 27

Other 5 5

Total 100% 100%

The Company's targeted asset allocation as of December 31, 2006 is approximately 70% equity securities, 25% debt securities and

5% other. The Company believes that its long-term asset allocation on average will approximate the targeted allocation. The Company

regularly reviews its actual asset allocation and periodically rebalances its investments to its targeted allocation when considered

appropriate.

(b) Defined Contribution Plans

The Company sponsors several defined contribution plans for certain employees. The Company makes cash contributions to certain

plans based on the employee's age, compensation, a match that is annually determined by the Board of Directors, and elected

contributions. The Company also participates in a multi-employer plan for certain employees. Expenses related to these plans, excluding

expenses related to the Company's pilot defined contribution plans (see below), were approximately $28 million, $16 million and

$11 million for the years ended December 31, 2006, 2005 and 2004, respectively.

In connection with its first reorganization under Chapter 11 of the Bankruptcy Code, US Airways terminated the Retirement Income

Plan for Pilots of US Airways, Inc. and the related nonqualified pilot plan effective March 31, 2003. The Company implemented a

qualified and nonqualified defined contribution plan for pilots effective April 1, 2003. The defined contribution amount was individually

determined based on a target normal retirement date balance of approximately $1 million for a career US Airways pilot. The target

balance included the estimated value of other retirement benefits including, but not limited to, the estimated benefit pilots are expected to

receive from the PBGC, the trustee for the terminated pilot defined benefit plan. Effective October 15, 2004, each pilot's contribution rate

became the lesser of the original rate or 10% of eligible compensation. Expenses for this plan were $42 million for 2006, $16 million for

2005 and $11 million for 2004 and are included in the Company's consolidated financial results.

Effective January 1, 2005 America West Holdings amended its defined contribution plan, requiring AWA to make a non-elective

discretionary employer contribution equal to 7% of the annual compensation for each pilot covered under the collective bargaining

agreement between AWA and the Air Line Pilots Association (as defined in the plan and subject to statutory annual maximums).

Effective January 1, 2006 the non-elective discretionary employer contribution was increased to 10% of each pilot's annual

compensation. These non-elective discretionary employer contributions replace the existing AWA company match under the 401(k)

defined contribution plan for pilots. The AWA company match continues for all other eligible covered employees under the plan. AWA's

contribution expense to this plan totaled $19 million and $13 million for 2006 and 2005, respectively.

(c) Postemployment Benefits

The Company provides certain postemployment benefits to its employees. These benefits include disability-related and workers'

compensation benefits for certain employees. The Company accrues for the cost of such benefit expenses once an appropriate triggering

event has occurred.

109