US Airways 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

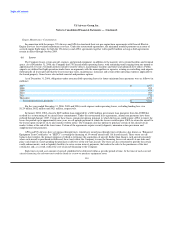

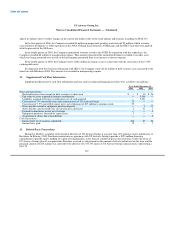

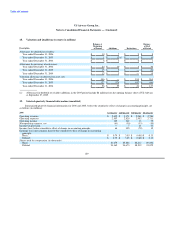

Information concerning operating revenues in principal geographic areas is as follows (in millions):

Year Ended Year Ended Year Ended

December 31, 2006 December 31, 2005 December 31, 2004

United States $ 9,397 $ 4,567 $ 2,581

Foreign 2,160 502 176

Total $ 11,557 $ 5,069 $ 2,757

The Company attributes operating revenues by geographic region based upon the origin and destination of each flight segment. The

Company's tangible assets consist primarily of flight equipment, which are mobile across geographic markets and, therefore, have not

been allocated.

16. Stockholders' Equity

(a) Common Stock

Holders of common stock are entitled to one vote per share on all matters submitted to a vote of common shareholders, except that

voting rights of non-U.S. citizens are limited to the extent that the shares of common stock held by such non-U.S. persons would

otherwise be entitled to more than 24.9% of the aggregate votes of all outstanding equity securities of US Airways Group. Holders of

common stock have no right to cumulate their votes. Holders of common stock participate equally as to any dividends or distributions on

the common stock.

On September 30, 2005, US Airways Group completed a public offering of common stock in which it issued 9,775,000 shares of its

common stock at a price of $19.30 per share. The Company received net proceeds of $180 million from the offering.

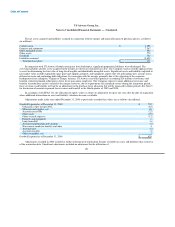

(b) Warrants

As compensation for various elements of AWA's financial restructuring completed in January 2002, America West Holdings issued

a warrant to purchase 18.8 million shares of its Class B common stock to the ATSB and additional warrants to purchase 3.8 million

shares of its Class B common stock to other loan participants, in each case at an exercise price of $3 per share and a term of ten years. For

accounting purposes, the warrants were valued at $35.4 million, or $1.57 per share, using the Black-Scholes pricing model with the

following assumptions: expected dividend yield of 0.0%, risk-free interest rate of 4.8%, volatility of 44.9% and an expected life of ten

years. The warrants were recorded by AWA as a non-cash capital contribution in the accompanying consolidated statements of

stockholders' equity and comprehensive income and classified as other assets, net in the accompanying consolidated balance sheets. The

warrants were amortized over the life of the AWA ATSB Loan as an increase to interest expense. In the first quarter of 2004,

approximately 220,000 warrants were exercised at $3 per share. In the third quarter of 2003, approximately 2.6 million warrants were

exercised at $3 per share. These warrant exercises were cashless transactions resulting in the issuance of approximately 1.6 million shares

of America West Holdings' Class B common stock.

In the fourth quarter of 2005, US Airways Group announced an agreement to repurchase all of the replacement warrants issued to

the ATSB in connection with the merger with America West Holdings. US Airways Group repurchased approximately 7.7 million

warrants to purchase shares of common stock that had an exercise price of $7.27 per share. The total purchase price for the warrants was

$116 million, which approximated their fair value at the purchase date. In connection with this repurchase, AWA recorded $8 million of

nonoperating expense. This amount represented the unamortized balance recorded in other assets, which was being amortized over the

life of the AWA ATSB Loan as an increase to interest expense.

123