US Airways 2006 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

returns; and a $1 million credit associated with reduced costs in connection with the integration of the AWA FlightFund and

US Airways Dividend Miles frequent traveler programs.

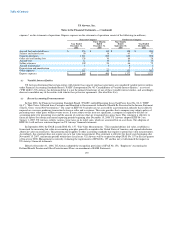

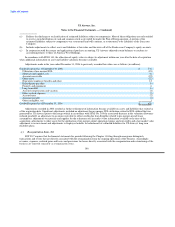

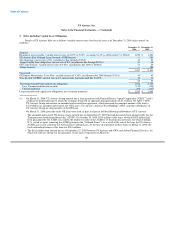

Severance charges and payment activity related to the merger are as follows:

Year ended December 31,

2006 2005

Balance beginning of year $ 7 $ —

Amount recorded by US Airways in purchase accounting — 24

Severance expense 11 —

Payments (18) (17)

Balance end of year $ — $ 7

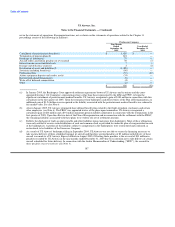

Due to the requirements for continued service, severance expense is recorded over the remaining service period. The Company

expects to record severance expense and make remaining termination and benefit payments of $1 million during 2007.

(c) In connection with the merger and the Airbus MOU executed between AVSA S.A.R.L, an affiliate of Airbus S.A.S. ("Airbus"),

US Airways Group, US Airways and AWA, certain aircraft firm orders were restructured. In connection with that restructuring,

US Airways Group and America West Holdings were required to pay restructuring fees totaling $89 million by means of set-off

against existing equipment deposits of US Airways and AWA held by Airbus of $39 million and $50 million, respectively. Also in

connection with the Airbus MOU, US Airways and AWA entered into two loan agreements with aggregate commitments of up to

$161 million and $89 million. As described in further detail in Note 5, on March 31, 2006, the outstanding principal and accrued

interest on the $89 million loan was forgiven upon repayment in full of the $161 million loan in accordance with terms of the

Airbus loans. As a result, US Airways recognized a gain associated with the return of these equipment deposits upon forgiveness

of the loan totaling $40 million, consisting of the $39 million in equipment deposits and accrued interest of $1 million.

(d) In the fourth quarter of 2006, US Airways recognized a $3 million gain in connection with the settlement of a property tax

bankruptcy claim.

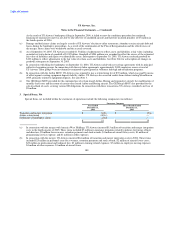

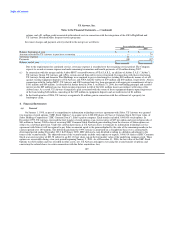

4. Financial Instruments

(a) General

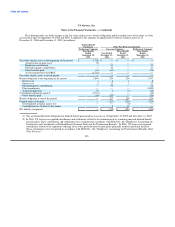

On January 1, 1998, as part of a comprehensive information technology services agreement with Sabre, US Airways was granted

two tranches of stock options ("SHC Stock Options") to acquire up to 6,000,000 shares of Class A Common Stock, $0.01 par value, of

Sabre Holdings Corporation ("SHC Common Stock"), Sabre's parent company. Each tranche included 3,000,000 stock options. In

December 1999, US Airways exercised the first tranche of stock options at an exercise price of $27 per option and received proceeds of

$81 million in January 2000 in lieu of receiving SHC Common Stock. Realized gains resulting from the exercise of Sabre options are

subject to a clawback provision. Under the clawback provision, if US Airways elects to terminate its information technology service

agreement with Sabre it will be required to pay Sabre an amount equal to the gain multiplied by the ratio of the remaining months in the

contract period over 180 months. The deferred gain from the 1999 exercise is amortized on a straight-line basis over a contractually

determined period ending December 2012. In February 2000, SHC declared a cash dividend resulting in a dilution adjustment to the

terms of the second tranche. The adjusted terms of the second tranche include stock options to acquire 3,406,914 shares of SHC Common

Stock at an exercise price of $23.78 subject to an $111.83 per share cap on the fair market value of the underlying common stock. These

options are exercisable during a ten-year period beginning January 2, 2003. As of December 31, 2006, the fair value of the SHC Stock

Options was $21 million and was recorded in other assets, net. US Airways anticipates exercising the second tranche of options and

converting the related shares to cash in connection with the Sabre acquisition. Any

189