US Airways 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

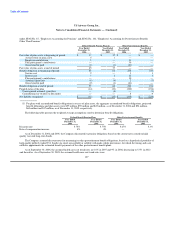

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

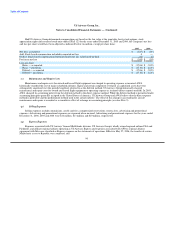

(g) In the first quarter of 2004, AWA recorded a $1 million reduction in special charges related to the revision of estimated costs

associated with the sale and leaseback of certain aircraft.

(h) In December 2004, AWA and General Electric ("GE") mutually agreed to terminate the V2500 A-1 power by hour ("PBH")

agreement effective January 1, 2005. This agreement was entered into March 1998 with an original term of ten years. For

terminating the agreement early, AWA received a $20 million credit to be applied to amounts due for other engines under the 1998

agreement. AWA had capitalized PBH payments for V2500 A-1 engines in excess of the unamortized cost of the overhauls

performed by GE of approximately $4 million. With the termination of this agreement, these payments were not realizable and as a

result, AWA wrote off this amount against the $20 million credit referred to above, resulting in a $16 million net gain.

(i) In the fourth quarter of 2006, the Company recognized $14 million in gains in connection with the settlement of bankruptcy

claims, which includes $11 million related to the Bombardier settlement, see Note 10(a).

6. Financial instruments

(a) General

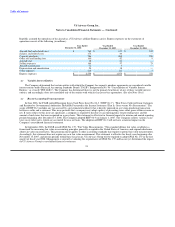

On January 1, 1998, as part of a comprehensive information technology services agreement with Sabre, US Airways was granted

two tranches of stock options ("SHC Stock Options") to acquire up to 6,000,000 shares of Class A Common Stock, $0.01 par value, of

Sabre Holdings Corporation ("SHC Common Stock"), Sabre's parent company. Each tranche included 3,000,000 stock options. In

December 1999, US Airways exercised the first tranche of stock options at an exercise price of $27 per option and received proceeds of

$81 million in January 2000 in lieu of receiving SHC Common Stock. Realized gains resulting from the exercise of Sabre options are

subject to a clawback provision. Under the clawback provision, if US Airways elects to terminate its information technology service

agreement with Sabre, it will be required to pay Sabre an amount equal to the gain multiplied by the ratio of the remaining months in the

contract period over 180 months. The deferred gain from the 1999 exercise is amortized on a straight-line basis over a contractually

determined period ending December 2012. In February 2000, SHC declared a cash dividend resulting in a dilution adjustment to the

terms of the second tranche. The adjusted terms of the second tranche include stock options to acquire 3,406,914 shares of SHC Common

Stock at an exercise price of $23.78 subject to a $111.83 per share cap on the fair market value of the underlying common stock. These

options are exercisable during a ten-year period beginning January 2, 2003. As of December 31, 2006, the fair value of the SHC Stock

Options was $21 million and was recorded in other assets, net. On December 12, 2006, Sabre announced that it had agreed to be acquired

by several private equity groups for $32.75 per share in cash. The Company anticipates exercising the second tranche of options and

converting the related shares to cash in connection with the Sabre acquisition. Any gain realized on the eventual sale of Sabre stock from

the exercise of the second tranche of options will be subject to the same clawback provisions as the first tranche.

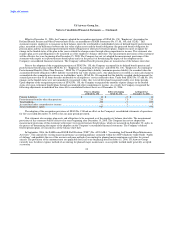

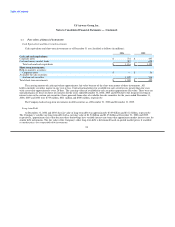

(b) Fuel Price Risk Management

Under its fuel hedging program, the Company may enter into certain hedging transactions with approved counterparties for a period

generally not exceeding 12 months. As of December 31, 2006, the Company had entered into costless collar transactions hedging

approximately 29% of the Company's projected 2007 fuel requirements. The fair value of the financial derivative instruments was a net

liability of $66 million and a net asset of $4 million at December 31, 2006 and 2005, respectively. As of December 31, 2006, the

Company had $48 million of deposits held as collateral on the open fuel hedge positions that are recorded as prepaid expenses and other

on the consolidated balance sheets.

The Company is exposed to credit risks in the event any counterparty to a hedge transaction fails to meet its obligations. The

Company does not anticipate such non-performance as counterparties are selected based on credit ratings and exposure to any one

counterparty is closely monitored.

98