US Airways 2006 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

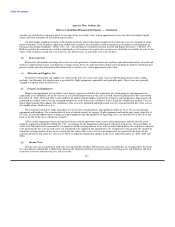

maturity are classified as cash equivalents. Cash equivalents are stated at cost, which approximates fair value due to the highly liquid

nature and short maturities of the underlying securities.

All other highly liquid investments with original maturities greater than three months but less than one year are classified as short-

term investments. Debt securities, other than auction rate securities, are classified as held-to-maturity in accordance with Statement of

Financial Accounting Standards ("SFAS") No. 115, "Accounting for Certain Investments in Debt and Equity Securities" ("SFAS 115").

Held-to-maturity investments are carried at amortized cost. Investments in auction rate securities are classified as available for sale, as the

terms of the securities exceed one year; however, the interest rates are generally reset every 28 days.

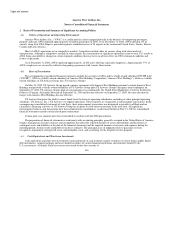

(d) Restricted Cash

Restricted cash includes cash deposits in trust accounts primarily to fund certain taxes and fees and collateralize letters of credit and

workers' compensation claims, cash deposits securing certain letters of credit and surety bonds and cash deposits held by institutions that

process credit card sales transactions. Restricted cash is stated at cost, which approximates fair value.

(e) Materials and Supplies, Net

Inventories of materials and supplies are valued at the lower of cost or fair value. Costs are determined using average costing

methods. An allowance for obsolescence is provided for flight equipment expendable and repairable parts. These items are generally

charged to expense when issued for use.

(f) Property and Equipment

Property and equipment are recorded at cost. Interest expenses related to the acquisition of certain property and equipment are

capitalized as an additional cost of the asset or as a leasehold improvement if the asset is leased. Interest capitalized for the years ended

December 31, 2006, 2005 and 2004 was $1 million, $3 million and $2 million, respectively. Property and equipment is depreciated and

amortized to residual values over the estimated useful lives or the lease term, whichever is less, using the straight-line method. Costs of

major improvements that enhance the usefulness of the asset are capitalized and depreciated over the estimated useful life of the asset or

the modifications, whichever is less.

The estimated useful lives range from three to 12 years for owned property and equipment and from 18 to 30 years for training

equipment and buildings. The estimated useful lives of owned aircraft, jet engines, flight equipment and rotable parts range from five to

25 years. Leasehold improvements relating to flight equipment and other property on operating leases are amortized over the life of the

lease or the life of the asset, whichever is shorter.

AWA records impairment losses on long-lived assets used in operations when events and circumstances indicate that the assets

might be impaired as defined by SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets." Recoverability of

assets to be held and used is measured by a comparison of the carrying amount of an asset to undiscounted future net cash flows expected

to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by

which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the

carrying amount or fair value less cost to sell. AWA recorded no impairment charges in the years ended December 31, 2006, 2005 and

2004.

(g) Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future

tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their

respective tax bases and operating loss and tax credit

137