US Airways 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

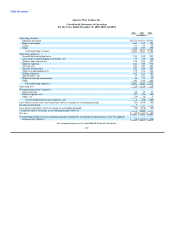

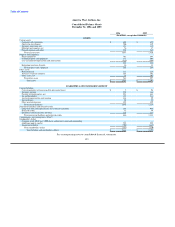

America West Airlines, Inc.

Notes to Consolidated Financial Statements

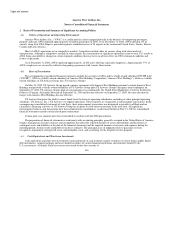

1. Basis of Presentation and Summary of Significant Accounting Policies

(a) Nature of Operations and Operating Environment

America West Airlines, Inc. ("AWA") is a certificated air carrier engaged primarily in the business of transporting passengers,

property and mail. AWA enplaned approximately 21 million passengers in 2006. As of December 31, 2006, AWA operated 133 jet

aircraft, along with AWA Express, provided regularly scheduled service at 98 airports in the continental United States, Alaska, Hawaii,

Canada and Latin America.

Most of AWA's operations are in competitive markets. Competitors include other air carriers along with other modes of

transportation. Although a competitive strength in some regards, the concentration of significant operations in the western U.S. results in

AWA being susceptible to changes in certain regional conditions that may have an adverse effect on AWA's financial condition and

results of operations.

As of December 31, 2006, AWA employed approximately 12,400 active full-time equivalent employees. Approximately 77% of

AWA's employees are covered by collective bargaining agreements with various labor unions.

(b) Basis of Presentation

The accompanying consolidated financial statements include the accounts of AWA and its wholly owned subsidiary FTCHP, LLC

("FTCHP"). AWA is a wholly owned subsidiary of America West Holdings Corporation ("America West Holdings"), which is a wholly

owned subsidiary of US Airways Group, Inc ("US Airways Group").

On May 19, 2005, US Airways Group signed a merger agreement with America West Holdings pursuant to which America West

Holdings merged with a wholly owned subsidiary of US Airways Group upon US Airways Group's emergence from bankruptcy on

September 27, 2005. US Airways Group's plan of reorganization was confirmed by the United States Bankruptcy Court for the Eastern

District of Virginia, Alexandria Division on September 16, 2005 and became effective on September 27, 2005, the same day that the

merger with America West Holdings became effective.

US Airways Group has the ability to move funds freely between its operating subsidiaries, including its other principal operating

subsidiary, US Airways, Inc. ("US Airways") to support operations. These transfers are recognized as intercompany transactions. In the

accompanying consolidated statements of cash flows, these intercompany transactions are designated as payable to affiliate and are

classified as financing activities as US Airways Group has no plans to settle these transactions in the near term. All significant

intercompany balances and transactions have been eliminated in consolidation. As discussed further in Note 13, AWA's consolidated

financial statements include certain related party transactions.

Certain prior year amounts have been reclassified to conform with the 2006 presentation.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from those estimates. The principal areas of judgment relate to passenger revenue

recognition, impairment of long-lived assets and intangible assets, and accounting for the frequent traveler program.

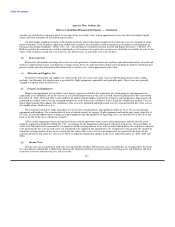

(c) Cash Equivalents and Short-term Investments

Cash equivalents and short-term investments consist primarily of cash in money market securities of various banks, highly liquid

debt instruments, commercial paper and asset-backed securities of various financial institutions and securities backed by the

U.S. government. All highly liquid investments purchased within three months of

136