US Airways 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

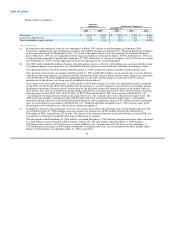

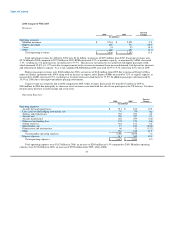

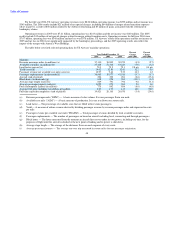

compensation deduction. Of this amount $795 million is available to reduce federal taxable income in 2007. Deferred tax assets, which

include the $795 million of NOL discussed above, have been subject to a valuation allowance. As of December 31, 2006, that valuation

allowance was $263 million. We utilized NOL in 2006, a portion of which was reserved by a valuation allowance. The use of the NOL

permitted the reversal of the valuation allowance which reduced income tax expenses. In 2007, we expect to utilize additional NOL and

as a result, the remaining valuation allowance will be reduced.

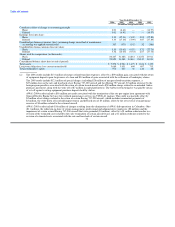

For the full year 2006, US Airways recognized $85 million of non-cash income tax expense, as NOL that was generated by

US Airways prior to the merger was utilized. In accordance with SFAS No. 109, "Accounting for Income Taxes," as this was acquired

NOL, the decrease in the valuation allowance associated with this NOL reduced goodwill instead of the provision for income taxes. As of

December 31, 2006, the remaining valuation allowance associated with acquired NOL was $29 million.

We were subject to Alternative Minimum Tax liability ("AMT") in 2006. In most cases the recognition of AMT does not result in

tax expense. However, since our NOL was subject to a full valuation allowance, any liability for AMT is recorded as tax expense. We

recorded AMT tax expense of $10 million for the full year 2006. We also recorded $2 million of state income tax provision in 2006

related to certain states where NOL was not available to be used.

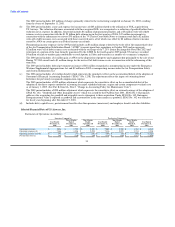

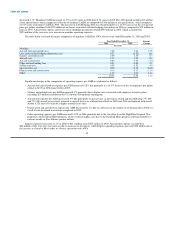

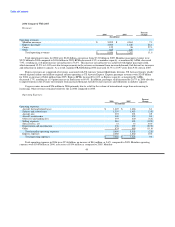

In 2005, we realized operating losses of $217 million and a loss before cumulative effect of change in accounting principle of

$335 million. In 2005, America West Holdings changed its accounting policy for certain maintenance costs from the deferral method to

the direct expense method as if that change occurred January 1, 2005. This resulted in a $202 million loss from the cumulative effect of a

change in accounting principle, or $6.41 per common share. See note 3, "Change in Accounting Policy for Maintenance Costs," to the

consolidated financial statements in Item 8A of this report.

The 2005 results include $75 million of net gains associated with AWA's fuel hedging transactions. This includes $71 million of net

realized gains on settled hedge transactions and $4 million of unrealized gains resulting from the application of mark-to-market

accounting for changes in the fair value of fuel hedging instruments.

The 2005 results include $121 million of special charges, including $28 million of merger related transition expenses, a $27 million

loss on the sale and leaseback of six 737-300 aircraft and two 757 aircraft, $7 million of power by the hour program penalties associated

with the return of certain leased aircraft and a restructuring fee of $50 million related to the amended Airbus purchase agreement, along

with $7 million in capitalized interest. The restructuring fee was paid by means of set-off against existing equipment purchase deposits

held by Airbus. The 2005 results also include nonoperating expenses of $8 million related to the write-off of the unamortized value of the

ATSB warrants upon their repurchase in October 2005 and an aggregate $2 million write-off of debt issuance costs associated with the

exchange of the 7.25% Senior Exchangeable Notes due 2023 and retirement of a portion of the loan formerly guaranteed by the ATSB.

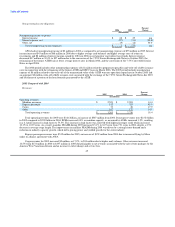

In 2004, we realized operating losses of $20 million and a loss before cumulative effect of change in accounting principle of

$89 million. These results include a $16 million net credit associated with the termination of the rate per engine hour agreement with

General Electric Engine Services for overhaul maintenance services on V2500-A1 engines. This credit was partially offset by $2 million

of net charges related to the return of certain Boeing 737-200 aircraft, which includes termination payments of $2 million, the write-down

of leasehold improvements and deferred rent of $3 million, offset by the net reversal of maintenance reserves of $3 million related to the

returned aircraft.

The 2004 results also include a $24 million net gain on derivative instruments associated with AWA's fuel hedging program. This

amount includes $26 million of realized gains on settled hedge transactions and $2 million of unrealized losses resulting from

mark-to-market accounting for changes in the fair value of AWA's fuel hedging instruments. A $6 million charge arising from the

resolution of pending litigation, a $5 million loss on the sale and leaseback of two new Airbus aircraft and a $1 million charge for the

write-off of debt issuance costs in connection with the refinancing of the Mizuho Corporate Bank term loan were also recognized in 2004.

40