US Airways 2006 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

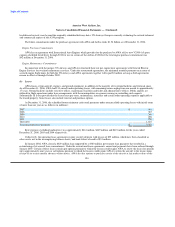

In addition, AWA is also the lessee under certain long-term leases at various airports. At certain of these airports, municipalities

have issued revenue bonds to improve airport facilities that are leased by AWA and accounted for as operating leases. AWA does not

guarantee the underlying debt related to these operating leases.

AWA is the lessee under many aircraft financing agreements (including leveraged lease financings of aircraft under pass through

trusts) and real estate leases. It is common in such transactions for AWA as the lessee to agree to indemnify the lessor and other related

third parties for the manufacture, design, ownership, financing, use, operation and maintenance of the aircraft, and for tort liabilities that

arise out of or relate to AWA's use or occupancy of the leased asset. In some cases, this indemnity extends to related liabilities arising

from the negligence of the indemnified parties, but usually excludes any liabilities caused by their gross negligence or willful misconduct.

Additionally, in the case of real estate leases, AWA typically indemnifies such parties for any environmental liability that arises out of or

relates to AWA's use of the leased premises.

US Airways, America West Holdings, AWA, and other subsidiaries of US Airways Group are all guarantors of the $1.25 billion GE

Loan.

US Airways Group's 7% Senior Convertible Notes are fully and unconditionally guaranteed, jointly and severally and on a senior

unsecured basis, by US Airways and AWA.

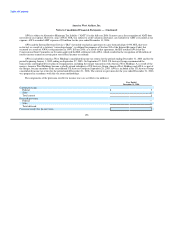

(f) Concentration of Credit Risk

AWA invests available cash in money market securities of various banks, commercial paper and asset-backed securities of various

financial institutions, other companies with high credit ratings and securities backed by the U.S. government.

As of December 31, 2006, most of AWA's receivables related to tickets sold to individual passengers through the use of major

credit cards or to tickets sold by other airlines and used by passengers on AWA or its regional airline affiliates. These receivables are

short-term, mostly being settled within seven days after sale. Bad debt losses, which have been minimal in the past, have been considered

in establishing allowances for doubtful accounts. AWA does not believe it is subject to any significant concentration of credit risk.

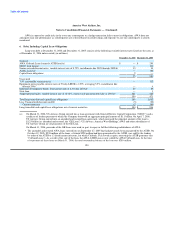

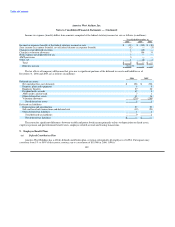

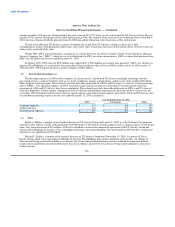

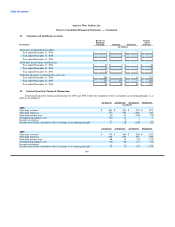

8. Income Taxes

AWA accounts for income taxes according to the provisions in SFAS No. 109, "Accounting for Income Taxes." AWA files a

consolidated federal income tax return with its parent company, US Airways Group. US Airways Group and its wholly owned

subsidiaries allocate tax and tax items, such as net operating losses ("NOL") and net tax credits, between members of the group based on

their proportion of taxable income and other items. Accordingly, AWA's tax expense is based on its taxable income, taking into

consideration its allocated tax loss carryforwards/carrybacks and tax credit carryforwards.

In assessing the realizability of the deferred tax assets, management considers whether it is more likely than not that some portion or

all of the deferred tax assets will be realized. AWA has recorded a valuation allowance against its net deferred tax asset. The ultimate

realization of deferred tax assets is dependent upon the generation of future taxable income (including reversals of deferred tax liabilities)

during the periods in which those temporary differences will become deductible.

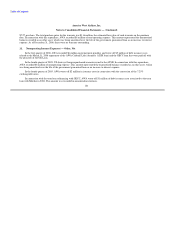

As of December 31, 2006, AWA has available NOL carryforwards and tax credit carry forwards for federal income tax purposes of

approximately $400 million and $7 million, respectively. The NOL expires during the years 2022 through 2025. As a result of a statutory

"ownership change" (as defined for purposes of Section 382 of the Internal Revenue Code) that occurred as a result of America West

Holding's merger with US Airways Group on September 27, 2005, AWA's ability to utilize its regular and AMT NOL and tax credit

carryforwards may be restricted.

157