US Airways 2006 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

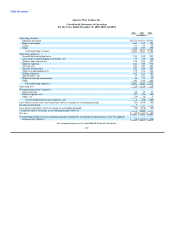

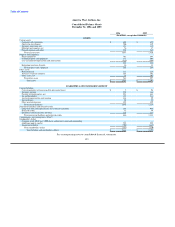

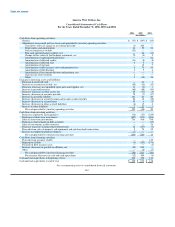

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

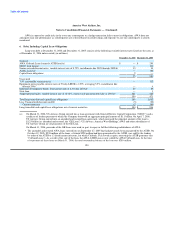

as capitalized assets that were subsequently amortized over the periods benefited (referred to as the deferral method). US Airways Group

historically charged maintenance and repair costs for owned and leased flight equipment to operating expense as incurred (direct expense

method). In 2005, AWA changed its accounting policy from the deferral method to the direct expense method. While the deferral method

is permitted under accounting principles generally accepted in the United States of America, US Airways Group and AWA believe that

the direct expense method is preferable and the predominant method used in the airline industry. The effect of this change in accounting

for aircraft maintenance and repairs is recorded as a cumulative effect of a change in accounting principle (see also Note 2, "Change in

Accounting Policy for Maintenance Costs").

(o) Selling Expenses

Selling expenses include commissions, credit card fees, computerized reservations systems fees and advertising and promotional

expenses. Advertising and promotional expenses are expensed when incurred. Advertising and promotional expenses for the years ended

December 31, 2006, 2005 and 2004 were $9 million, $12 million and $10 million, respectively.

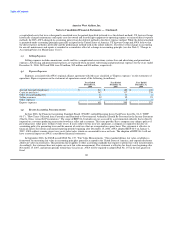

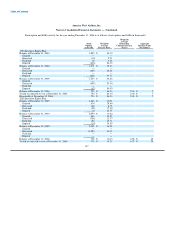

(p) Express Expenses

Expenses associated with AWA's regional alliance agreement with Mesa are classified as "Express expenses" on the statements of

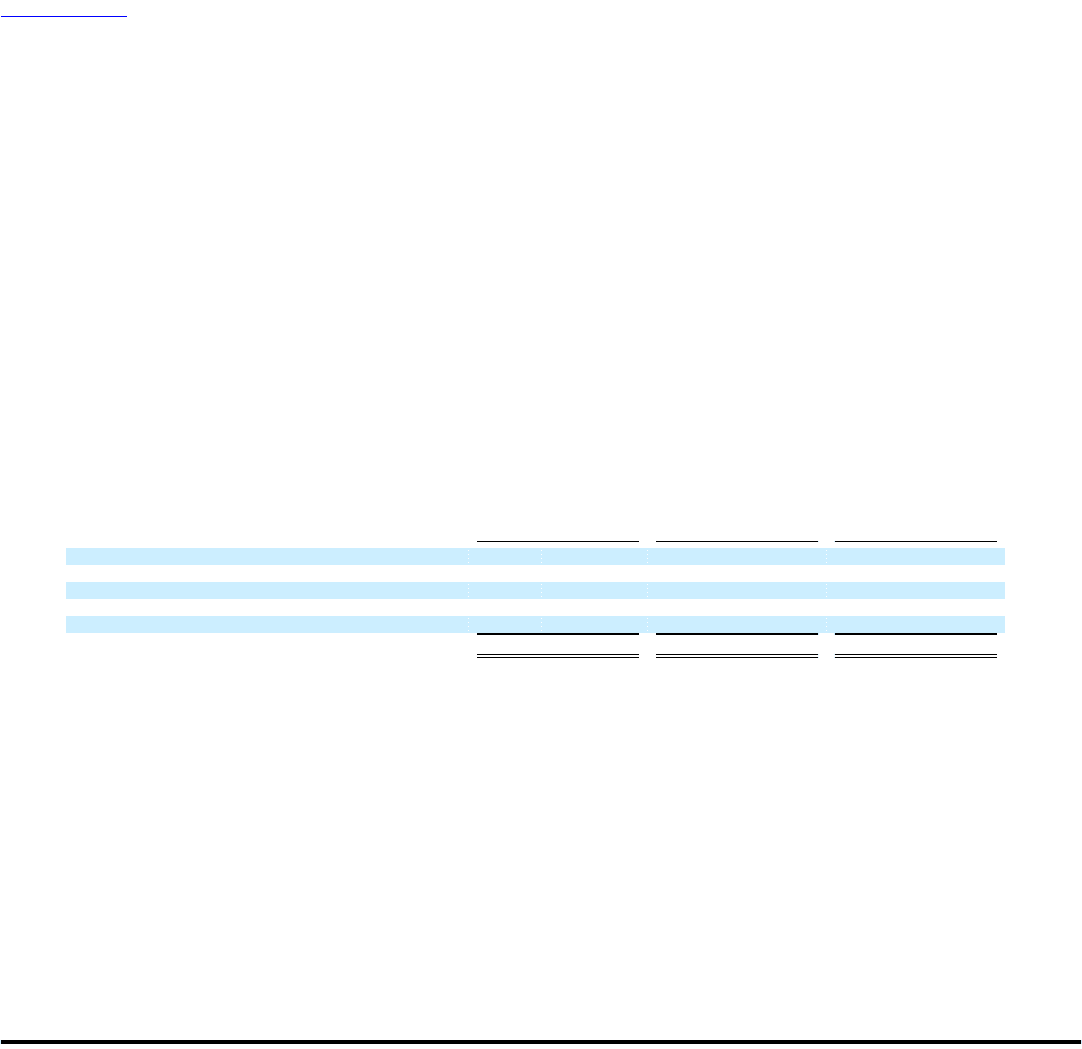

operations. Express expenses on the statements of operations consist of the following (in millions):

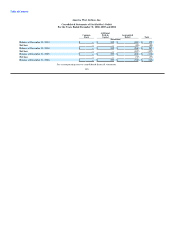

Year Ended Year Ended Year Ended

December 31, December 31, December 31,

2006 2005 2004

Aircraft fuel and related taxes $ 210 $ 182 $ 102

Capacity purchases 347 317 238

Other rent and landing fees 12 11 8

Selling expenses 39 32 23

Other expenses 3 3 3

Express expenses $ 611 $ 545 $ 374

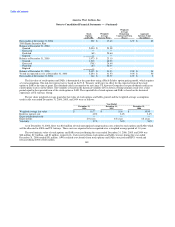

(q) Recent Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board ("FASB") ratified Emerging Issues Task Force Issue No. 06-3 ("EITF

06-3"), "How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement

(That Is, Gross versus Net Presentation)." The scope of EITF 06-3 includes any tax assessed by a governmental authority that is directly

imposed on a revenue-producing transaction between a seller and a customer. This issue provides that a company may adopt a policy of

presenting taxes either gross within revenue or net. If taxes subject to this issue are significant, a company is required to disclose its

accounting policy for presenting taxes and the amount of such taxes that are recognized on a gross basis. This statement is effective to

financial reports for interim and annual reporting periods beginning after December 15, 2006. AWA adopted EITF 06-3 on January 1,

2007. AWA collects various excise taxes on its ticket sales, which are accounted for on a net basis. The adoption of EITF 06-3 will not

have a material impact on AWA's consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements." This standard defines fair value, establishes a

framework for measuring fair value in accounting principles generally accepted in the United States of America, and expands disclosure

about fair value measurements. This pronouncement applies to other accounting standards that require or permit fair value measurements.

Accordingly, this statement does not require any new fair value measurement. This statement is effective for fiscal years beginning after

November 15, 2007, and interim periods within those fiscal years. AWA will be required to adopt SFAS No. 157 in the first quarter of

fiscal

141