US Airways 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

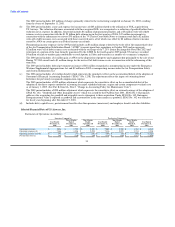

The 2002 period includes $19 million of charges primarily related to the restructuring completed on January 18, 2002, resulting

from the events of September 11, 2001.

(b) The 2006 period includes a non-cash expense for income taxes of $85 million related to the utilization of NOL acquired from

US Airways. The valuation allowance associated with these acquired NOL was recognized as a reduction of goodwill rather than a

reduction in tax expense. In addition, the period includes $6 million of prepayment penalties and a $5 million write-off of debt

issuance costs in connection with the $1.25 billion debt refinancing in the first quarter of 2006, $17 million in payments in

connection with the inducement to convert $70 million of the 7% Senior Convertible Notes to common stock and a $2 million

write-off of debt issuance costs associated with those converted notes, all of which was offset by $8 million of interest income

earned by AWA on certain prior year Federal income tax refunds.

Nonoperating income (expense) in the 2005 period includes an $8 million charge related to the write-off of the unamortized value

of the Air Transportation Stabilization Board ("ATSB") warrants upon their repurchase in October 2005 and an aggregate

$2 million write-off of debt issuance costs associated with the exchange of the 7.25% Senior Exchangeable Notes due 2023 and

retirement of a portion of the loan formerly guaranteed by the ATSB. In the fourth quarter 2005 period, US Airways recorded

$4 million of mark-to-market gains attributable to stock options in Sabre and warrants in a number of e-commerce companies.

The 2004 period includes a $1 million gain at AWA on the disposition of property and equipment due principally to the sale of one

Boeing 737-200 aircraft and a $1 million charge for the write-off of debt issuance costs in connection with the refinancing of the

term loan.

The 2003 period includes federal government assistance of $81 million recognized as nonoperating income under the Emergency

Wartime Supplemental Appropriations Act and $9 million in 2002 as nonoperating income under the Air Transportation Safety

and System Stabilization Act.

(c) The 2006 period includes a $1 million benefit which represents the cumulative effect on the accumulated deficit of the adoption of

Statement of Financial Accounting Standards ("SFAS") No. 123R. The adjustment reflects the impact of estimating future

forfeitures for previously recognized compensation expense.

The 2005 period includes a $202 million adjustment which represents the cumulative effect on the accumulated deficit of the

adoption of the direct expense method of accounting for major scheduled airframe, engine and certain component overhaul costs

as of January 1, 2005. (See Part II, Item 8A, Note 3 "Change in Accounting Policy for Maintenance Costs").

The 2002 period includes a $208 million adjustment which represents the cumulative effect on retained earnings of the adoption of

SFAS No. 142, "Goodwill and Other Intangible Assets" which was issued by the FASB in June 2001. SFAS No. 142 primarily

addresses the accounting for goodwill and intangible assets subsequent to their acquisition. Under SFAS No. 142, Enterprise

Reorganizational Value is reported as goodwill and accounted for in the same manner as goodwill. SFAS No. 142 was effective

for fiscal years beginning after December 15, 2001.

(d) Includes debt, capital leases, postretirement benefits other than pensions (noncurrent) and employee benefit and other liabilities.

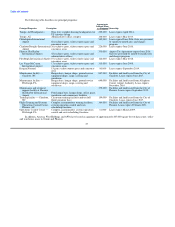

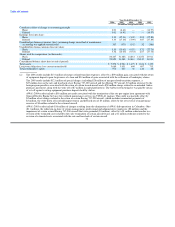

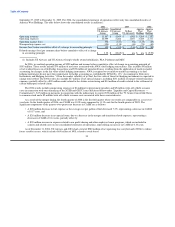

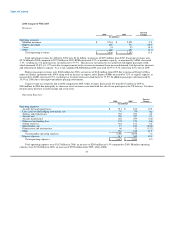

Selected Financial Data of US Airways, Inc.

Statements of Operations (in millions):

Successor Company(a) Predecessor Company(a)

Three Months Nine Months Nine Months Three Months

Year Ended Ended Ended Year Ended Ended Ended Year Ended

December 31, December 31, September 30, December 31, December 31, March 31, December 31,

2006 2005 2005 2004 2003 2003 2002

Operating revenues $ 8,056 $ 1,755 $ 5,452 $ 7,068 $ 5,250 $ 1,512 $ 6,915

Operating expenses(b) 7,464 1,826 5,594 7,416 5,292 1,714 8,236

Operating income (loss)(b) $ 592 $ (71) $ (142) $ (348) $ (42) $ (202) $ (1,321)

Net income (loss)(c) $ 345 $ (120) $ 280 $ (578) $ (160) $ 1,613 $ (1,659)

33