US Airways 2006 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

goodwill for impairment during the fourth quarter of 2006. US Airways concluded that the fair value of the reporting unit was in excess

of the carrying value. US Airways assessed the fair value of the reporting unit considering both the income approach and market

approach. Under the market approach, the fair value of the reporting unit is based on quoted market prices for US Airways Group

common stock and the number of shares outstanding of US Airways Group common stock. Under the income approach, the fair value of

the reporting unit is based on the present value of estimated future cash flows.

Other intangible assets consist primarily of trademarks, international route authorities and airport take-off and landing slots and

airport gates. As of December 31, 2006 and 2005, US Airways had $55 million and $56 million of international route authorities on the

balance sheets, respectively. The carrying value of trademarks was $30 million as of December 31, 2006 and 2005. International route

authorities and trademarks are classified as indefinite lived assets under SFAS 142. Indefinite-lived assets are not amortized but instead

are reviewed for impairment annually and more frequently if events or circumstances indicate that the asset may be impaired.

International route authorities and trademarks were tested for impairment during the fourth quarter of 2006, at which time US Airways

concluded that no impairment exists. US Airways will perform its next annual impairment test on October 1, 2007.

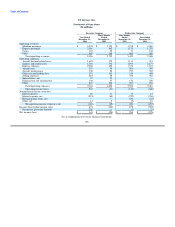

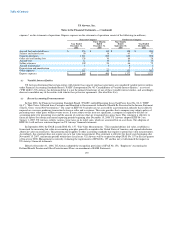

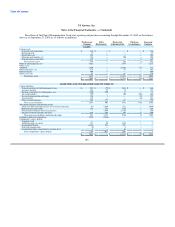

SFAS 142 requires that intangible assets with estimable useful lives be amortized over their respective estimated useful lives to their

estimated residual values, and reviewed for impairments in accordance with SFAS 144. The following table provides information relating

to US Airways' intangible assets subject to amortization as of December 31, 2006 and 2005 (in millions):

2006 2005

Airport take-off and landing slots $ 411 $ 411

Airport gate leasehold rights 52 52

Accumulated amortization (35) (8)

Total $ 428 $ 455

The intangible assets subject to amortization generally are amortized over 25 years for airport take-off and landing slots, over the

term of the lease for airport gate leasehold rights and over five years for capitalized software costs on a straight-line basis and are

included in depreciation and amortization on the statements of operations. For the years ended December 31, 2006, the three months

ended December 31, 2005, the nine months ended September 30, 2005, and the year ended December 31, 2004, US Airways recorded

amortization expense of $27 million, $8 million, $19 million, and $35 million, respectively, related to its intangible assets. US Airways

expects to record annual amortization expense of $23 million in year 2007, $23 million in year 2008, $23 million in year 2009,

$22 million in year 2010, and $20 million in year 2011 related to these intangible assets.

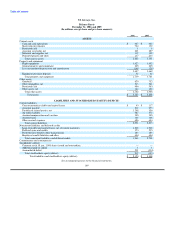

(i) Other Assets, Net

Other assets, net consists of the following as of December 31, 2006 and 2005:

2006 2005

Deposits $ 7 $ 9

Debt issuance costs 3 —

Long term investments 30 10

Deferred rent 30 —

Aircraft leasehold interest, net 101 101

Subtotal 171 120

Less: accumulated amortization (7) —

Total other assets, net $ 164 $ 120

175