US Airways 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

Engine Maintenance Commitments

In connection with the merger, US Airways and AWA restructured their rate per engine hour agreements with General Electric

Engine Services for overhaul maintenance services. Under the restructured agreements, the minimum monthly payment on account of

accrued engine flight hours for both the US Airways and AWA agreements together will equal $3 million as long as both agreements

remain in effect through October 2009.

(b) Leases

The Company leases certain aircraft, engines, and ground equipment, in addition to the majority of its ground facilities and terminal

space. As of December 31, 2006, the Company had 376 aircraft under operating leases, with remaining terms ranging from one month to

approximately 18 years. Ground facilities include executive offices, maintenance facilities and ticket and administrative offices. Public

airports are utilized for flight operations under lease arrangements with the municipalities or agencies owning or controlling such airports.

Substantially all leases provide that the lessee must pay taxes, maintenance, insurance and certain other operating expenses applicable to

the leased property. Some leases also include renewal and purchase options.

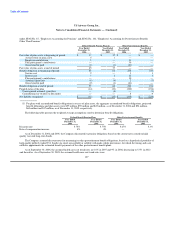

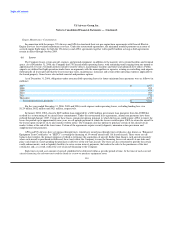

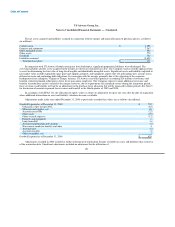

As of December 31, 2006, obligations under noncancelable operating leases for future minimum lease payments were as follows (in

millions):

2007 $ 1,077

2008 995

2009 874

2010 787

2011 722

Thereafter 4,706

Total minimum lease payments $ 9,161

For the years ended December 31, 2006, 2005 and 2004, rental expense under operating leases, excluding landing fees, was

$1.24 billion, $632 million and $421 million, respectively.

In January 2002, AWA closed a $429 million loan supported by a $380 million government loan guarantee from the ATSB that

resulted in a restructuring of its aircraft lease commitments. Under the restructured lease agreements, annual rent payments have been

reduced through January 2007. Certain of these leases contain put options pursuant to which the lessors could require AWA to renew the

leases for periods up to approximately nine years or call options pursuant to which the lessors could require AWA to return the aircraft to

the lessors upon receipt of six to nine months written notice. The Company also has options to purchase certain of the aircraft at fair

market values at the end of the lease terms. Certain of the agreements require security deposits, minimum return provisions and

supplemental rent payments.

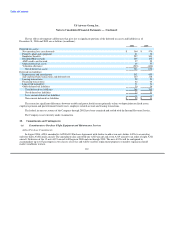

AWA and US Airways have set up pass through trusts, which have issued pass through trust certificates (also known as "Enhanced

Equipment Trust Certificates" or "EETCs") covering the financing of 19 owned aircraft and 116 leased aircraft. These trusts are off-

balance sheet entities, the primary purpose of which is to finance the acquisition of aircraft. Rather than finance each aircraft separately

when such aircraft is purchased or delivered, these trusts allow the Company to raise the financing for several aircraft at one time and

place such funds in escrow pending the purchase or delivery of the relevant aircraft. The trusts are also structured to provide for certain

credit enhancements, such as liquidity facilities to cover certain interest payments, that reduce the risks to the purchasers of the trust

certificates and, as a result, reduce the cost of aircraft financing to the Company.

Each trust covered a set amount of aircraft scheduled to be delivered within a specific period of time. At the time of each covered

aircraft financing, the relevant trust used the funds in escrow to purchase equipment notes

114