US Airways 2006 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

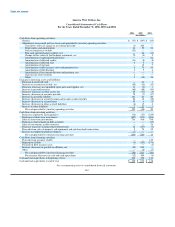

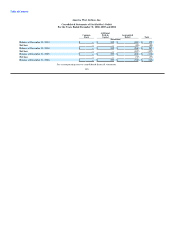

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

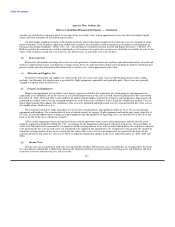

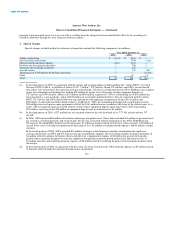

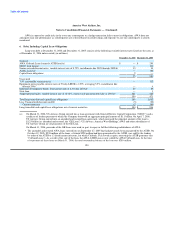

(e) In the third and fourth quarter of 2005, AWA recorded severance expense totaling approximately $2 million for terminated

employees resulting from the merger.

(f) In August 2004, AWA entered into definitive agreements with two lessors to return six Boeing 737-200 aircraft. Three of these

aircraft were returned to the lessors in the third quarter of 2004, two were returned in the fourth quarter of 2004 and one was

returned in January 2005. In connection with the return of the aircraft, AWA recorded $2 million of special charges in 2004, which

include lease termination payments of $2 million and the write-down of leasehold improvements and aircraft rent balances of

$3 million, offset by the net reversal of lease return provisions of $3 million. In the first quarter of 2005, AWA recorded $1 million

in special charges related to the final Boeing 737-200 aircraft which was removed from service in January 2005.

(g) In the first quarter of 2004, AWA recorded a $1 million reduction in special charges related to the revision of estimated costs

associated with the sale and leaseback of certain aircraft.

(h) In December 2004, AWA and GE mutually agreed to terminate the V2500 A-1 power by hour ("PBH") agreement effective

January 1, 2005. This agreement was entered into March 1998 with an original term of ten years. For terminating the agreement

early, AWA received a $20 million credit to be applied to amounts due for other engines under the 1998 agreement. AWA had

capitalized PBH payments for V2500 A-1 engines in excess of the unamortized cost of the overhauls performed by GE of

approximately $4 million. With the termination of this agreement, these payments were not realizable and as a result, AWA wrote

off this amount against the $20 million credit referred to above, resulting in a $16 million net gain.

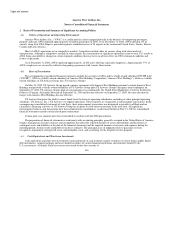

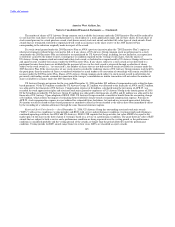

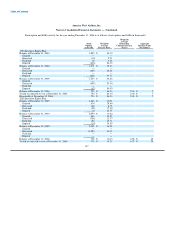

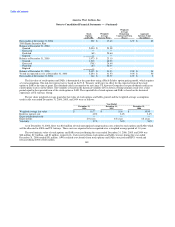

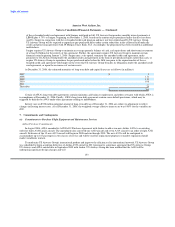

4. Stock-based Compensation

Prior to January 1, 2006, US Airways Group accounted for stock-based compensation plans in accordance with APB 25 and related

interpretations. Effective January 1, 2006, US Airways Group adopted SFAS 123R, using the modified prospective transition method.

Under the modified prospective transition method, compensation cost is recognized in the financial statements beginning with the

effective date based on the requirements of SFAS 123R for all share-based payments granted after that date, and based on the

requirements of SFAS 123 for all unvested awards granted prior to the effective date of SFAS 123R. Results for prior periods are not

restated using the modified prospective transition method.

Substantially all of America West Holdings and AWA employee stock options outstanding at the time of the merger were fully

vested in accordance with the change of control provisions of America West Holdings' stock option plans and were converted into

options of US Airways Group. Existing stock options of US Airways Group outstanding prior to the merger on September 27, 2005 were

cancelled as part of the plan of reorganization. Accordingly, as of January 1, 2006, only unvested stock options, stock appreciation rights

and restricted stock units granted subsequent to and in connection with the merger are subject to the transition provisions of SFAS 123R.

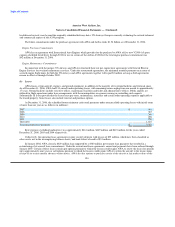

As part of the plan of reorganization, the Bankruptcy Court approved a new equity incentive plan, referred to as the 2005 Incentive

Equity Plan (the "2005 Incentive Plan"). The 2005 Incentive Plan provides for the grant of incentive stock options, nonstatutory stock

options, stock appreciation rights, stock purchase awards, stock bonus awards, stock unit awards, and other forms of equity

compensation, collectively referred to as stock awards, as well as performance-based cash awards. Incentive stock options granted under

the 2005 Incentive Plan are intended to qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue

Code of 1986, as amended. Nonstatutory stock options granted under the 2005 Incentive Plan are not intended to qualify as incentive

stock options under the Internal Revenue Code.

A maximum of 12.5% of the fully-diluted shares (as of the completion of the merger) of US Airways Group common stock is

available for issuance under the 2005 Incentive Plan, totaling 10,969,191 shares. Any or all of these shares may be granted pursuant to

incentive stock options. Shares of US Airways Group common stock issued under the 2005 Incentive Plan may be unissued shares or

reacquired shares, purchased on the open market or otherwise. At December 31, 2006, approximately 5.5 million shares are available for

grant under the 2005 Equity Incentive Plan.

144