US Airways 2006 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

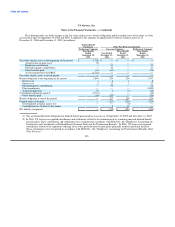

contribution rate became the lessor of the original rate or 10% of eligible compensation. Expenses for this plan were $42 million,

$10 million, $32 million, and $134 million for the year ended December 31, 2006, the three months ended December 31, 2005, the nine

months ended September 30, 2005, and the year ended December 31, 2004, respectively.

(c) Postemployment Benefits

US Airways provides certain postemployment benefits to its employees. These benefits include disability-related benefits for certain

employees. US Airways accrues for the cost of these benefit expenses once an appropriate triggering event has occurred.

(d) Profit Sharing Plans

Most non-executive employees of US Airways Group are eligible to participate in the 2005 Profit Sharing Plan, an annual bonus

program, which was established subsequent to the merger. Annual bonus awards are paid from a profit-sharing pool equal to (i) ten

percent of the annual profits of US Airways Group (excluding unusual items) for pre-tax profit margins up to ten percent, plus (ii) 15% of

the annual profits of US Airways Group (excluding unusual items) for pre-tax profit margins greater than ten percent. Awards are paid as

a lump sum no later than March 15 after the end of each fiscal year. The profit-sharing pool is shared among eligible employee groups in

proportion to each group's share of overall cost savings achieved through US Airways' 2005 transformation plan; however, the

represented pilots' and flight attendants' portions of the pool will not be less than 36% and 14.5%, respectively. An employee's share of

the pool is based on the ratio that the employee's compensation bears to the respective employee group's aggregate compensation.

US Airways recorded $36 million for profit sharing in 2006, which is recorded in salaries and related costs.

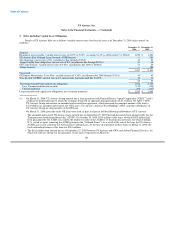

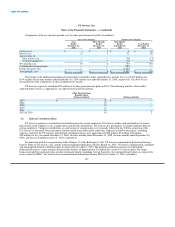

7. Income Taxes

US Airways accounts for income taxes according to the provisions in SFAS No. 109, "Accounting for Income Taxes." US Airways

files a consolidated federal income tax return with its parent company, US Airways Group. US Airways Group and its wholly owned

subsidiaries allocate tax and tax items, such as net operating losses ("NOL") and net tax credits, between members of the group based on

their proportion of taxable income and other items. Accordingly, US Airways' tax expense is based on its taxable income, taking into

consideration its allocated tax loss carryforwards/carrybacks and tax credit carryforwards.

In assessing the realizability of the deferred tax assets, management considers whether it is more likely than not that some portion or

all of the deferred tax assets will be realized. US Airways has recorded a valuation allowance against its net deferred tax asset. The

ultimate realization of deferred tax assets is dependent upon the generation of future taxable income (including reversals of deferred tax

liabilities) during the periods in which those temporary differences will become deductible.

As of December 31, 2006, US Airways has a $580 million federal net operating loss carryforwards with $428 million expiring in

2024, $151 million expiring in 2025, and $30 million of alternative minimum tax credits which do not expire.

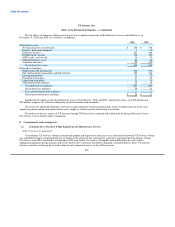

During 2006, US Airways utilized NOL that was generated prior to the merger. In accordance with SFAS No. 109, as this was

acquired NOL, the corresponding decrease in the valuation allowance reduced goodwill instead of the provision for income taxes.

Accordingly, US Airways Group recognized $85 million of non-cash tax expense for the year ended December 31, 2006. As of

December 31, 2006, the remaining valuation allowance associated with acquired NOL is approximately $23 million related to state NOL.

US Airways is subject to Alternative Minimum Tax liability ("AMT") for the full year 2006. In most cases, the recognition of AMT

does not result in tax expense. However, since US Airways' NOL was subject to a full valuation allowance, any liability for AMT is

recorded as tax expense. US Airways recorded AMT expense of $1 million for

198