US Airways 2006 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

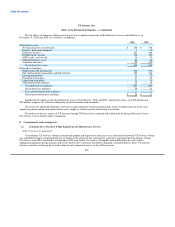

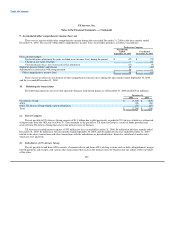

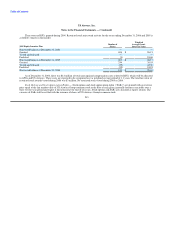

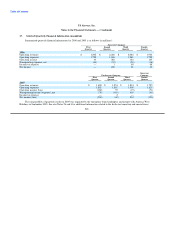

US Airways also reflect shared expenses incurred at more than 30 overlap airports where the operations of US Airways and AWA have

been consolidated. These shared costs have been allocated based on US Airways' and AWA's respective departures at those airports.

Management believes that the methodologies underlying the allocation of these shared costs are reasonable. The following details the

total corporate shared expenses and airport shared expenses allocated to US Airways and AWA that are included in operating expenses

for the year ended December 31, 2006 (in millions):

Year Ended

December 31, 2006

AWA US Airways Total

Corporate Expenses $ 167 $ 266 $ 433

Airport Expenses 112 197 309

Total Allocated Expenses $ 279 $ 463 $ 742

11. Stockholder's Equity and Dividend Restrictions

US Airways Group owns all of US Airways' outstanding common stock, par value $1 per share. US Airways' board of directors has

not authorized the payment of dividends on the common stock since 1988.

US Airways, organized under the laws of the State of Delaware, is subject to Sections 160 and 170 of the Delaware General

Corporation Law with respect to the payment of dividends on or the repurchase or redemption of its capital stock. US Airways is

restricted from engaging in any of these activities unless it maintains a capital surplus. In addition, US Airways may not pay dividends in

accordance with provisions contained in the GE Loan.

12. Nonoperating Income (Expenses) — Other, Net

In 2006 and 2005, US Airways recorded $11 million and $4 million, respectively, of derivative gains attributable to stock options in

Sabre and warrants in a number of companies. On an ongoing basis, US Airways adjusts its balance sheet to reflect changes in the current

fair market value of the stock options and warrants according to SFAS 133.

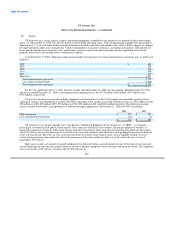

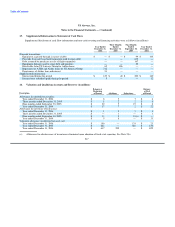

13. Operating Segments and Related Disclosures

US Airways Group is managed as a single business unit that provides air transportation for passengers and cargo. This allows it to

benefit from an integrated revenue pricing and route network that includes US Airways, AWA, Piedmont, PSA and third-party carriers

that fly under capacity purchase agreements as part of US Airways Express. The flight equipment of all these carriers is combined to

form one fleet that is deployed through a single route scheduling system. When making resource allocation decisions, the chief operating

decision maker evaluates flight profitability data, which considers aircraft type and route economics, but gives no weight to the financial

impact of the resource allocation decision on an individual carrier basis. The objective in making resource allocation decisions is to

maximize consolidated financial results, not the individual results of US Airways, AWA, Piedmont and PSA.

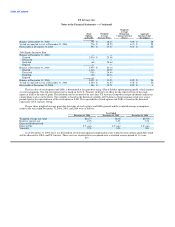

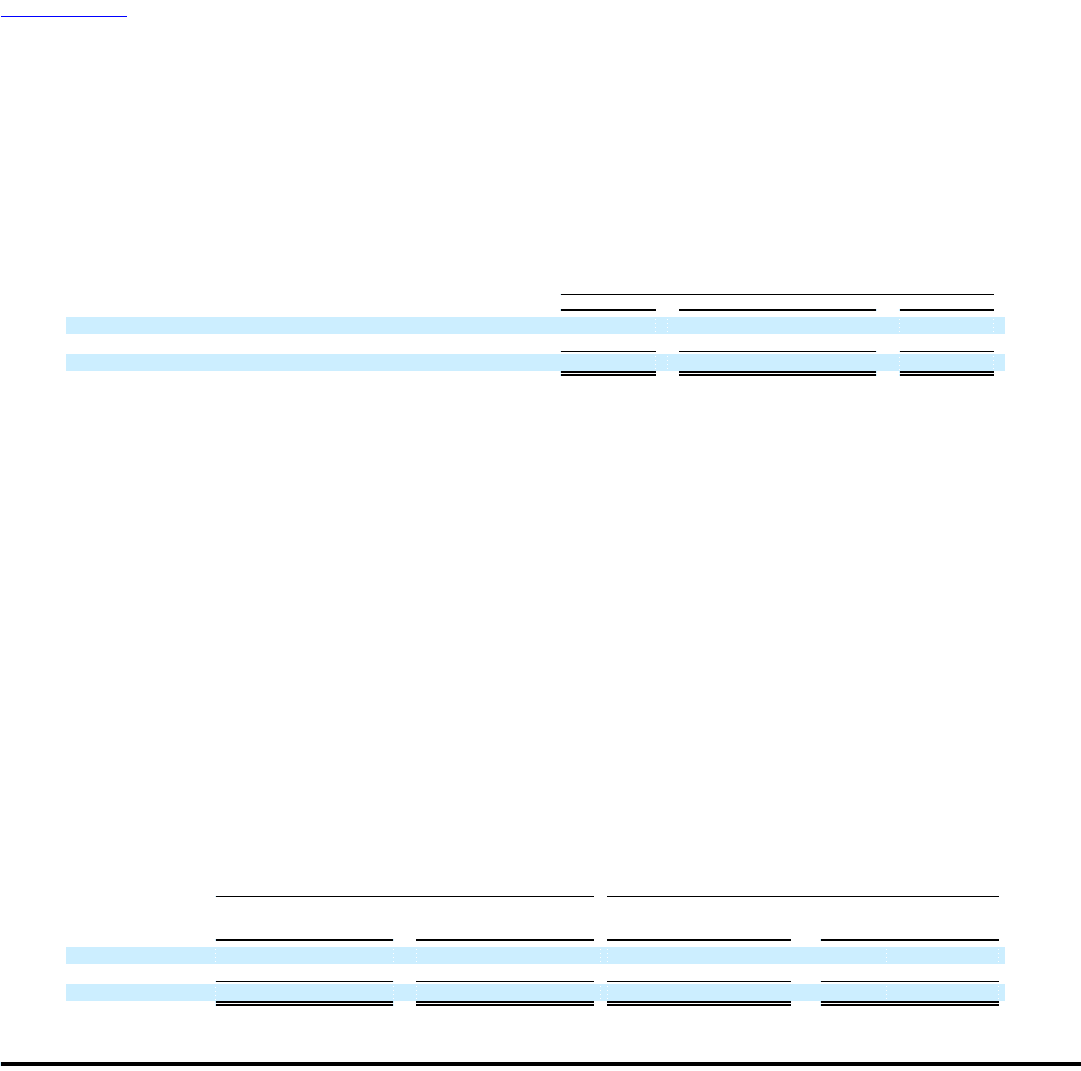

Information concerning operating revenues in principal geographic areas is as follows (in millions):

Successor Company Predecessor Company

Three Months Nine Months

Year Ended Ended Ended Year Ended

December 31, 2006 December 31, 2005 September 30, 2005 December 31, 2004

United States $ 6.232 $ 1,501 $ 4,508 $ 5,220

Foreign 1.824 254 944 1,848

Total $ 8.056 $ 1,755 $ 5,452 $ 7,068

209