US Airways 2006 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

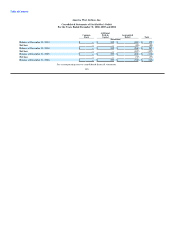

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

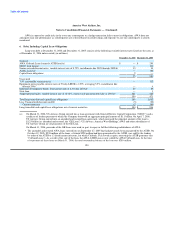

The number of shares of US Airways Group common stock available for issuance under the 2005 Incentive Plan will be reduced by

(i) one share for each share of stock issued pursuant to a stock option or a stock appreciation right, and (ii) three shares for each share of

stock issued pursuant to a stock purchase award, stock bonus award, stock unit award, and other full-value types of stock awards. Stock

awards that are terminated, forfeited or repurchased will result in an increase in the share reserve of the 2005 Incentive Plan

corresponding to the reduction originally made in respect of the award.

If a stock award granted under the 2005 Incentive Plan or AWA's previous incentive plan (the "2002 Incentive Plan") expires or

otherwise terminates without being exercised in full, or if any shares of US Airways Group common stock issued pursuant to a stock

award under the 2005 Incentive Plan are forfeited to or repurchased by US Airways Group, including, but not limited to, any repurchase

or forfeiture caused by the failure to meet a contingency or condition required for the vesting of such shares, then the shares of

US Airways Group common stock not issued under that stock award, or forfeited to or repurchased by US Airways Group, will revert to

and again become available for issuance under the 2005 Incentive Plan. If any shares subject to a stock award are not delivered to a

participant because those shares are withheld for the payment of taxes or the stock award is exercised through a reduction of shares

subject to the stock award (i.e., "net exercised"), the number of shares that are not delivered will remain available for issuance under the

2005 Incentive Plan. If the exercise price of any stock award is satisfied by tendering shares of US Airways Group common stock held by

the participant, then the number of shares so tendered (whether by actual tender or by attestation of ownership) will remain available for

issuance under the 2005 Incentive Plan. Shares of US Airways Group common stock subject to stock awards issued in substitution for

previously outstanding awards assumed in connection with a merger, consolidation or similar transaction will not reduce the number of

shares available for issuance under the 2005 Incentive Plan.

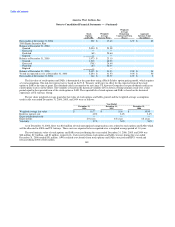

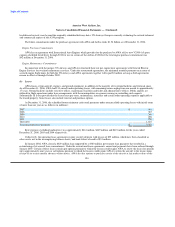

US Airways Group's net income for the year ended December 31, 2006 includes $35 million of compensation costs related to share-

based payments. Of the $35 million recorded by US Airways Group, $12 million was allocated to the financials of AWA and $23 million

was allocated to the financials of US Airways. Compensation expense of $4 million, calculated using the provisions of APB 25, was

recorded for stock appreciation rights and restricted stock units granted to employees of US Airways Group in the fourth quarter of 2005.

Of the $4 million recorded by US Airways Group, $3 million was allocated to the financials of AWA and $1 million was allocated to the

financials of US Airways. Upon adoption of SFAS 123R, US Airways Group recorded a cumulative benefit from the accounting change

of $1 million, which reflects the impact of estimating future forfeitures for previously recognized compensation expense. Pursuant to

APB 25, stock compensation expense was not reduced for estimated future forfeitures, but instead was reversed upon actual forfeiture.

No income tax effect related to share-based payments or cumulative effect has been recorded as the effects have been immediately offset

by the recording of a valuation allowance through the same financial statement caption.

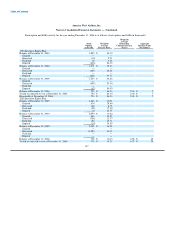

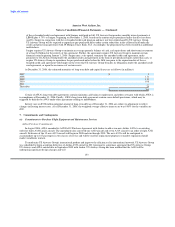

Restricted Stock Unit Awards — As of December 31, 2006, US Airways Group has outstanding restricted stock unit awards

("RSUs") with service conditions (vesting periods) and RSUs with service and performance conditions (vesting periods and obtaining a

combined operating certificate for AWA and US Airways). SFAS 123R requires that the grant-date fair value of RSUs be equal to the

market price of the share on the date of grant if vesting is based on a service or a performance condition. The grant-date fair value of RSU

awards that are subject to both a service and a performance condition are being expensed over the vesting period, as the performance

condition is considered probable and the vesting periods of the awards are longer than the period allowed to meet the performance

condition. Vesting periods for RSU awards range from two to four years. RSUs are classified as equity awards.

145