US Airways 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

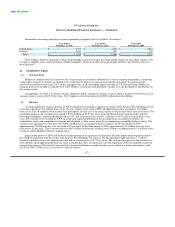

pre-merger NOL generated by US Airways prior to the merger, which in accordance with SFAS No. 109, the associated decrease in the

valuation allowance reduced goodwill; an adjustment to accounts receivable to reflect credits due from Republic related to pre-merger

aircraft lease assumptions; adjustments to materials and supplies for the refinement of fair market value information available at the time

of the acquisition; adjustments to other assets for the application of pre-merger airport operating expense and rent credits and a fair

market value adjustment to an investment; and adjustments to other accrued expenses to refine estimates for remaining pending

bankruptcy claim matters.

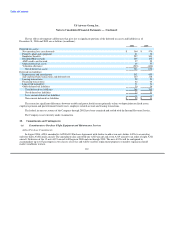

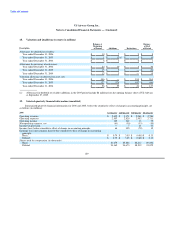

(b) Pro Forma Information

The following information is presented assuming the merger and the conversion of America West Holdings' Class A and Class B

common stock had been completed as of January 1, 2004. The pro forma consolidated results of operations include purchase accounting

adjustments, such as fair market value adjustments of the assets and liabilities of US Airways Group, adjustments to reflect the

disposition of prepetition liabilities upon US Airways Group's emergence from bankruptcy, and adjustments to conform certain

accounting policies of US Airways Group and America West Holdings, together with related income tax effects. Certain other

transactions critical to US Airways Group's emergence from bankruptcy and the completion of the merger that became effective either

before, at or immediately following the merger have also been reflected in the pro forma financial information. These transactions include

the new equity investments, the comprehensive agreements with GECC, the comprehensive agreement with Airbus, the restructuring of

the ATSB loans, and the restructuring of the credit card partner and credit card processing agreements. The unaudited pro forma

information presented below is not necessarily indicative of the results of operations that would have occurred had the purchase been

made at the beginning of the periods presented or of future results of the combined operations (in millions, except share and per share

amounts).

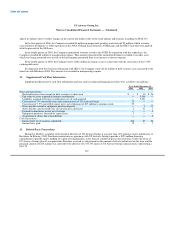

Year Ended Year Ended

December 31, 2005 December 31, 2004

Operating revenues $ 10,440 $ 9,456

Operating expenses 10,799 9,858

Operating loss (359) (402)

Net loss $ (891) $ (652)

Basic and fully diluted loss per share $ (12.59) $ (10.93)

Basic and diluted shares (in thousands) 70,689 59,654

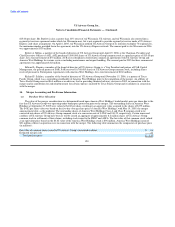

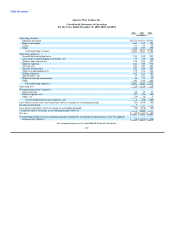

15. Operating segments and related disclosures

US Airways Group is managed as a single business unit that provides air transportation for passengers and cargo. This allows it to

benefit from an integrated revenue pricing and route network that includes US Airways, AWA, Piedmont, PSA and third-party carriers

that fly under capacity purchase agreements as part of the Company's Express operations. The flight equipment of all these carriers is

combined to form one fleet that is deployed through a single route scheduling system. When making resource allocation decisions, the

chief operating decision maker evaluates flight profitability data, which considers aircraft type and route economics, but gives no weight

to the financial impact of the resource allocation decision on an individual carrier basis. The objective in making resource allocation

decisions is to maximize consolidated financial results, not the individual results of US Airways, AWA, Piedmont and PSA.

122