US Airways 2006 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

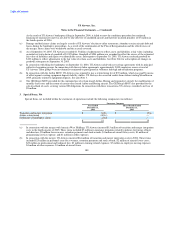

ultimately allowed will not be material. To the extent any of these claims are allowed, they will generally be satisfied in full.

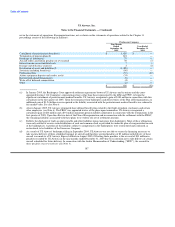

(b) Fresh-start Reporting and Purchase Accounting

In connection with its emergence from bankruptcy on September 27, 2005, US Airways adopted fresh-start reporting in accordance

with SOP 90-7. Accordingly, US Airways valued its assets and liabilities at fair value. In addition, as a result of the merger which is

accounted for as a reverse acquisition under SFAS No. 141 "Business Combinations," ("SFAS 141") with America West Holdings as the

accounting acquirer, US Airways Group applied the provisions of SFAS 141 and allocated the purchase price to the assets and liabilities

of US Airways Group and to its wholly owned subsidiaries including US Airways. The purchase price or value of the merger

consideration was determined based upon America West Holdings' traded market price per share due to the fact that US Airways Group

was operating under bankruptcy protection. The $4.82 per share value was based on the five-day average share price of America West

Holdings common stock, with May 19, 2005, the merger announcement date, as the midpoint. Certain unsecured creditors of US Airways

Group have been or will be issued an aggregate of approximately 8.2 million shares of US Airways Group common stock in settlement of

their claims, including stock issued to the PBGC and ALPA. The fair value of that common stock valued at an equivalent price based on

the $4.82 value of the America West Holdings stock is $96 million, which was determined to be the reorganization value of US Airways

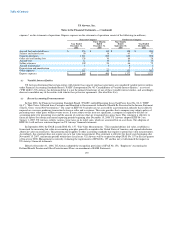

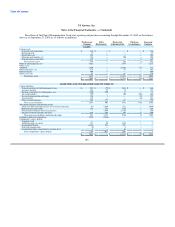

Group. America West Holdings incurred $21 million of direct acquisition costs in connection with the merger. The following table

summarizes the purchase price (in millions):

Fair value of common shares issued to US Airways Group's unsecured creditors $ 96

Estimated merger costs 21

Total purchase price $ 117

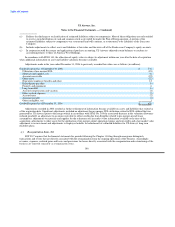

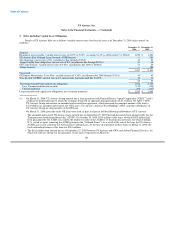

US Airways' equity value of $1 million was determined based on an allocation of the purchase price to each of US Airways Group's

subsidiaries' fair values of assets and liabilities. The remaining equity of $116 million was assigned to US Airways Group and its other

subsidiaries. In connection with US Airways' emergence from bankruptcy, significant prepetition liabilities were discharged. The

surviving liabilities and the assets acquired in the merger are shown at estimated fair value. Liabilities assumed reflects the discharge of

$1.24 billion of liabilities for postretirement benefits, $868 million of liabilities related to the termination of US Airways' defined benefit

pension plans and $75 million of liabilities related to trade accounts payable and other liabilities. Most of these obligations were only

entitled to receive such distributions of cash and common stock as provided for under the Plan of Reorganization. The surviving liabilities

and the assets acquired in the merger are shown at estimated fair value. US Airways used an outside appraisal firm to assist in

determining the fair value of long-lived tangible and identifiable intangible assets. Significant assets and liabilities adjusted to fair market

value include expendable spare parts and supplies, property and equipment, airport take-off and landing slots, aircraft leases, deferred

revenue and continuing debt obligations. The foregoing estimates and assumptions are inherently subject to significant uncertainties and

contingencies beyond the control of US Airways. Accordingly, there can be no assurance that the estimates, assumptions, and values

reflected in the valuations will be realized, and actual results could vary materially

The excess of the reorganization value over tangible assets and identifiable intangible assets and liabilities has been reflected as

goodwill on the balance sheet of December 31, 2005. The net assets acquired and liabilities

183