US Airways 2006 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

In connection with fresh-start reporting for US Airways, aircraft operating leases were adjusted to fair value and $101 million of

assets were established for leasehold interests in aircraft for aircraft leases with rental rates deemed to be below market rates. These

leasehold interests are amortized on a straight-line basis as an increase to aircraft rent expense over the applicable remaining lease

periods, generally 17 years.

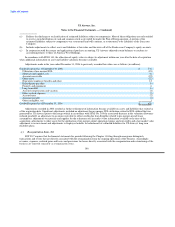

(j) Frequent Traveler Program

At the time of the merger, US Airways Group's principal operating subsidiaries, AWA and US Airways, maintained separate

frequent travel award programs known as "Flight Fund" and "Dividend Miles," respectively. Following the merger, the two frequent flyer

programs were modified to allow customers of each airline to earn and use miles on the other airline, and in May 2006, the two programs

were merged into the new Dividend Miles program, which is substantially the same as the former US Airways program. As part of the

merger of the plans, the accounts of members participating in both programs were merged into single accounts of the new program.

Members of the new Dividend Miles program can redeem miles on either AWA, US Airways, or other members of the Star Alliance.

During the second quarter of 2006, US Airways recorded a reduction in the liability of $1 million through special items, net — merger

related transition expenses as a result of reduced booking fees due to combining the two programs.

The estimated cost of providing the free travel, using the incremental cost method as adjusted for estimated redemption rates, is

recognized as a liability and charged to operations as program members accumulate mileage and requisite mileage award levels are

achieved. For travel awards on partner airlines, the liability is based on the average contractual amount to be paid to the other airline per

redemption. Costs associated with the Dividend Miles program are allocated between AWA and US Airways based on mainline RPMs.

As of December 31, 2006, Dividend Miles members had accumulated mileage credits for approximately 3.8 million awards. The portion

of US Airways Group's liability for the future travel awards accrued on US Airways' balance sheets within other accrued liabilities was

$166 million and $147 million as of December 31, 2006 and 2005, respectively.

US Airways sells mileage credits to participating airline and non-airline business partners. Revenue earned from selling mileage

credits to other companies is recognized in two components. A portion of the revenue from these sales is deferred, representing the

estimated fair value of the transportation component of the sold mileage credits. The deferred revenue for the transportation component is

amortized on a straight-line basis over the period in which the credits are expected to be redeemed for travel as passenger revenue, which

is currently estimated to be 28 months. The marketing component, which is earned at the time the miles are sold, is recognized in other

revenues at the time of the sale. As of December 31, 2006 and 2005, US Airways had $209 million and $204 million, respectively, in

deferred revenue from the sale of mileage credits included in other accrued liabilities on its balance sheets.

(k) Derivative Instruments

SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities" ("SFAS 133") requires all derivatives to be

recognized on the balance sheet at fair value. Derivatives that are not hedges must be adjusted to fair value through income. If the

derivative is a hedge, depending on the nature of the hedge, changes in the fair value of derivatives are either offset against the change in

fair value of assets, liabilities or firm commitments through earnings or recognized in other comprehensive income until the hedged item

is recognized in earnings. The ineffective portion of a hedging derivative's change in fair value is immediately recognized in earnings. As

of December 31, 2006 and 2005, US Airways had no open fuel hedge positions in place.

Due to the application of fresh-start reporting, US Airways recognized a one-time gain of $6 million related to unrecognized fuel

hedge gains included in reorganization items, net for the nine months ended September 30, 2005.

US Airways holds stock options in Sabre Holding Corporation ("Sabre") and warrants in a number of companies as a result of

service agreements with them. On an ongoing basis, US Airways adjusts its balance sheet to

176