US Airways 2006 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

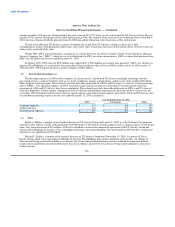

US Airways, Inc.

Notes to the Financial Statements — (Continued)

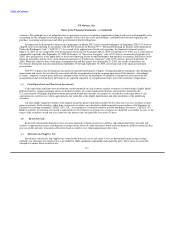

estimates. The principal areas of judgment relate to passenger revenue recognition, impairment of long-lived assets and intangible assets,

accounting for the frequent traveler program, estimates of fair value for assets and liabilities established in fresh-start reporting and

purchase accounting and pensions and other postretirement benefit obligations.

In connection with emergence from its first bankruptcy in March 2003 and its second bankruptcy in September 2005, US Airways

adopted fresh-start reporting in accordance with AICPA Statement of Position 90-7, "Financial Reporting by Entities in Reorganization

Under the Bankruptcy Code" ("SOP 90-7"). As a result of the application of fresh-start reporting, the financial statements prior to

March 31, 2003 are not comparable with the financial statements for the period April 1, 2003 to September 30, 2005, nor is either period

comparable to periods after September 30, 2005. References to "Successor Company" refer to US Airways on and after September 30,

2005, after giving effect to the application of fresh-start reporting for the second bankruptcy and purchase accounting. References in the

financial statements and the notes to the financial statements to "Predecessor Company" refer to US Airways prior to September 30,

2005. While the effective date of the plan of reorganization and the merger was September 27, 2005, the results of operations for

US Airways during the four day period from September 27 through September 30, 2005 are not material to the financial statement

presentation.

SOP 90-7 requires that the financial statements for periods following the Chapter 11 filing through the emergence date distinguish

transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Accordingly,

revenues, expenses, realized gains and losses and provisions for losses incurred prior to emergence and directly associated with the

reorganization and restructuring of the business are reported separately as reorganization items, net in the statements of operations.

(c) Cash Equivalents and Short-term Investments

Cash equivalents and short-term investments consist primarily of cash in money market securities of various banks, highly liquid

debt instruments, commercial paper and asset-backed securities of various financial institutions and securities backed by the

U.S. government. All highly liquid investments purchased within three months of maturity are classified as cash equivalents. Cash

equivalents are stated at cost, which approximates fair value due to the highly liquid nature and short maturities of the underlying

securities.

All other highly liquid investments with original maturities greater than three months but less than one year are classified as short-

term investments. Debt securities, other than auction rate securities, are classified as held-to-maturity in accordance with Statement of

Financial Accounting Standards ("SFAS") No. 115, "Accounting for Certain Investments in Debt and Equity Securities" ("SFAS 115").

Held-to-maturity investments are carried at amortized cost. Investments in auction rate securities are classified as available for sale, as the

terms of the securities exceed one year, however; the interest rates are generally reset every 28 days.

(d) Restricted Cash

Restricted cash includes deposits in trust accounts primarily to fund certain taxes and fees and collateralize letters of credit and

workers' compensation claims, cash deposits securing certain letters of credit and surety bonds and cash deposits held by institutions that

process credit card sales transactions. Restricted cash is stated at cost, which approximates fair value.

(e) Materials and Supplies, Net

Inventories of materials and supplies are valued at the lower of cost or fair value. Costs are determined using average costing

methods. An allowance for obsolescence is provided for flight equipment expendable and repairable parts. These items are generally

charged to expense when issued for use.

173