US Airways 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281

|

|

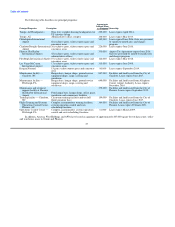

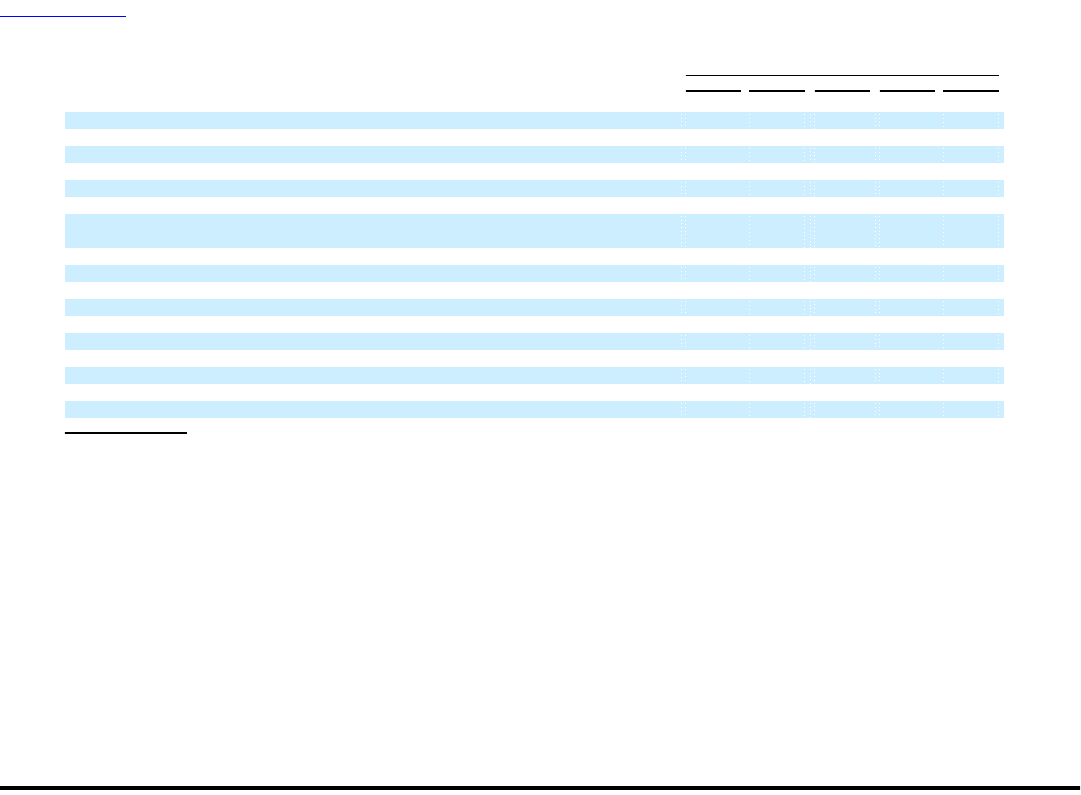

Table of Contents

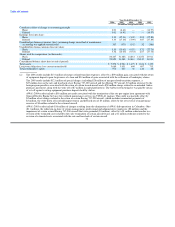

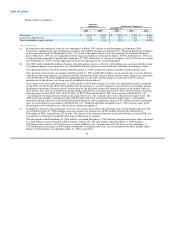

Year Ended December 31,

2006 2005 2004 2003 2002

(In millions except share data)

Cumulative effect of change in accounting principle

Basic 0.01 (6.41) — — (14.97)

Diluted 0.01 (6.41) — — (14.97)

Earnings (loss) per share:

Basic 3.51 (17.06) (5.99) 4.03 (27.89)

Diluted 3.33 (17.06) (5.99) 3.07 (27.89)

Unaudited pro forma net income (loss) (assuming change in method of maintenance

accounting was applied retroactively) 303 (335) (142) 52 (386)

Unaudited pro forma earnings (loss) per share

Basic 3.50 (10.65) (9.53) 3.71 (27.76)

Diluted 3.32 (10.65) (9.53) 2.87 (27.76)

Shares used for computation (in thousands):

Basic 86,447 31,488 14,861 14,252 13,911

Diluted 93,821 31,488 14,861 23,147 13,911

Consolidated balance sheet data (at end of period):

Total assets $ 7,576 $ 6,964 $ 1,475 $ 1,614 $ 1,439

Long-term obligations, less current maturities(d) 3,689 3,631 640 697 713

Total stockholders' equity 970 420 36 126 68

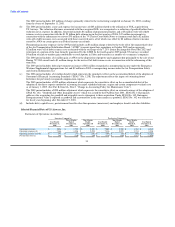

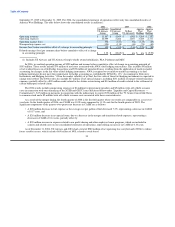

(a) The 2006 results include $131 million of merger related transition expenses, offset by a $90 million gain associated with the return

of equipment deposits upon forgiveness of a loan and $14 million of gains associated with the settlement of bankruptcy claims.

The 2005 results include $121 million of special charges, including $28 million of merger related transition expenses, a

$27 million loss on the sale and leaseback of six Boeing 737-300 aircraft and two Boeing 757 aircraft, $7 million of power by the

hour program penalties associated with the return of certain leased aircraft and a $50 million charge related to an amended Airbus

purchase agreement, along with the write off of $7 million in capitalized interest. The Airbus restructuring fee was paid by means

of set-off against existing equipment purchase deposits held by Airbus.

AWA's 2004 results include a $16 million net credit associated with the termination of the rate per engine hour agreement with

General Electric Engine Services for overhaul maintenance services on V2500-A1 engines. This credit was partially offset by

$2 million of net charges related to the return of certain Boeing 737-200 aircraft, which includes termination payments of

$2 million, the write-down of leasehold improvements and deferred rent of $3 million, offset by the net reversal of maintenance

reserves of $3 million related to the returned aircraft.

AWA's 2003 results include $16 million of charges resulting from the elimination of AWA's hub operations in Columbus, Ohio

($11 million), the reduction-in-force of certain management, professional and administrative employees ($2 million) and the

impairment of certain owned Boeing 737-200 aircraft that were grounded ($3 million), offset by a $1 million reduction due to a

revision of the estimated costs related to the early termination of certain aircraft leases and a $1 million reduction related to the

revision of estimated costs associated with the sale and leaseback of certain aircraft.

32