US Airways 2006 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

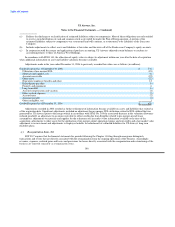

No. 87, 88, 106, and 132(R)." This statement requires employers to recognize in their balance sheets the overfunded or underfunded

status of defined benefit post-retirement plans, measured as the difference between the fair value of plan assets and the benefit obligation

(the projected benefit obligation for pension plans and the accumulated postretirement benefit obligation for other postretirement plans).

Employers must recognize the change in the funded status of the plan in the year in which the change occurs through other

comprehensive income.

Prior to the adoption of the recognition provisions of SFAS No. 158, US Airways accounted for its postretirement benefit plans in

accordance with SFAS No. 106, "Employers' Accounting for Postretirement Benefits Other Than Pensions." SFAS No. 106 required that

the liability recorded should represent the actuarial present value of all future benefits attributable to an employees' service rendered to

date. Under SFAS No. 106, changes in the funded status were not immediately recognized, rather, they were deferred and recognized

ratably over future periods. The impact of adopting the recognition provisions of SFAS No. 158 was not material. US Airways

recognized a nominal amount of prior changes in the funded status of its postretirement benefit plans through accumulated other

comprehensive income. The adoption of the recognition provisions of SFAS No. 158 had no effect on US Airways' statement of

operations for the year ended December 31, 2006 or for any prior period presented.

This statement also requires plan assets and obligations to be measured as of the employer's balance sheet date. The measurement

provisions of this statement will be effective for years beginning after December 15, 2008. US Airways has not yet adopted the

measurement provisions of this statement and is in the process of determining the impact of the adoption on its financial statements.

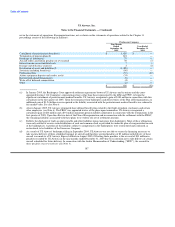

In September 2006, the FASB issued FASB Staff Position ("FSP") No. AUG AIR-1 "Accounting for Planned Major Maintenance

Activities". This amends the existing major maintenance accounting guidance contained within the AICPA Industry Audit Guide "Audits

of Airlines" and prohibits the use of the accrue in advance method of accounting for planned major maintenance activities for owned

aircraft. The provisions of the announcement are applicable for fiscal years beginning after December 15, 2006. US Airways currently

uses the direct expense method of accounting for planned major maintenance, an acceptable method under generally accepted accounting

principles in the United States of America. Therefore, the adoption of FSP No. AUG AIR-1 is not expected to have any material impact

on US Airways' financial statements.

In September 2006, the Securities and Exchange Commission ("SEC") issued Staff Accounting Bulletin No. 108 ("SAB 108"). Due

to diversity in practice among registrants, SAB 108 expresses SEC staff views regarding the process by which misstatements in financial

statements are evaluated for purposes of determining whether financial statement restatement is necessary. SAB 108 is effective for fiscal

years ending after November 15, 2006. US Airways has adopted SAB 108 in the fourth quarter of 2006 and its adoption had no effect on

the US Airways' financial statements for the year ended December 31, 2006 or for any prior period presented.

In June 2006, the FASB issued Interpretation No. 48, "Accounting for Uncertainty in Income Taxes, an interpretation of FASB

Statement No. 109" ("FIN 48"), which clarifies the accounting for uncertainty in income taxes recognized in financial statements. FIN 48

requires the impact of a tax position to be recognized in the financial statements if that position is more likely than not of being sustained

by the taxing authority. US Airways will be required to adopt FIN 48 in the first quarter of fiscal year 2007. Management has evaluated

the requirements of FIN 48 and does not expect it to have a material impact on US Airways' financial statements.

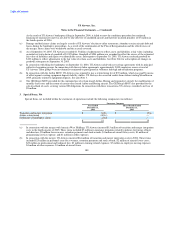

On November 10, 2005, the FASB issued FASB Staff Position No. FAS 123R-3, "Transition Election Related to Accounting for

Tax Effects of Share-Based Payment Awards." US Airways elected to adopt the modified prospective method, which is the simplified

method provided in the FASB Staff Position for calculating the tax effects of stock-based compensation pursuant to SFAS 123R. The

modified prospective method was used to determine the beginning balance of the additional paid-in capital pool ("APIC pool") related to

the tax effects of employee stock-based compensation. Due to US Airways' history of tax net operating losses, US Airways had no

beginning balance in the APIC pool at the date of adoption of SFAS 123R on January 1, 2006.

180