US Airways 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

transaction. The sale proceeds realized from the sale-leaseback transaction were applied to repay the liquidity facility obtained

from GE in 2003 in connection with the Company's emergence from its first bankruptcy (the "2003 GE Liquidity Facility"), the

mortgage financing associated with the CRJ aircraft and a portion of the 2001 GE Credit Facility. The balance of the GECC Credit

Facility was amended to allow additional borrowings of $21 million in July 2005, which resulted in a total principal balance

outstanding thereunder of $28 million. The operating leases are cross-defaulted with all other GE obligations, other than excepted

obligations, and are subject to agreed upon return conditions. On March 31, 2006, the agreement was amended to change the

maturity date from September 30, 2010 to December 31, 2008 and required the Company to make equal quarterly principal

payments through maturity beginning March 31, 2006.

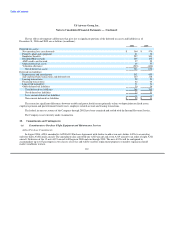

(g) On September 30, 2005, US Airways Group issued $144 million aggregate principal amount of 7% Senior Convertible Notes due

2020 (the "7% Senior Convertible Notes") for proceeds, net of expenses, of approximately $139 million. The 7% Senior

Convertible Notes are US Airways Group's senior unsecured obligations and rank equally in right of payment to its other senior

unsecured and unsubordinated indebtedness and are effectively subordinated to its secured indebtedness to the extent of the value

of assets securing such indebtedness. The 7% Senior Convertible Notes are fully and unconditionally guaranteed, jointly and

severally and on a senior unsecured basis, by US Airways Group's two major operating subsidiaries, US Airways and AWA. The

guarantees are the guarantors' unsecured obligations and rank equally in right of payment to the other senior unsecured and

unsubordinated indebtedness of the guarantors and are effectively subordinated to the guarantors' secured indebtedness to the

extent of the value of assets securing such indebtedness.

The 7% Senior Convertible Notes bear interest at the rate of 7% per year payable in cash semiannually in arrears on March 30 and

September 30 of each year, beginning March 30, 2006. The 7% Senior Convertible Notes mature on September 30, 2020.

Holders may convert, at any time on or prior to maturity or redemption, any outstanding notes (or portions thereof) into shares of

US Airways Group's common stock, initially at a conversion rate of 41.4508 shares of US Airways Group's common stock per

$1,000 principal amount of notes (equivalent to an initial conversion price of approximately $24.12 per share of US Airways

Group's common stock). If a holder elects to convert its notes in connection with certain specified fundamental changes that occur

prior to October 5, 2015, the holder will be entitled to receive additional shares of US Airways Group's common stock as a make

whole premium upon conversion. In lieu of delivery of shares of US Airways Group's common stock upon conversion of all or any

portion of the notes, US Airways Group may elect to pay holders surrendering notes for conversion cash or a combination of

shares and cash.

Holders may require US Airways Group to purchase for cash or shares or a combination thereof, at US Airways Group's election,

all or a portion of their 7% Senior Convertible Notes on September 30, 2010 and September 30, 2015 at a purchase price equal to

100% of the principal amount of the 7% Senior Convertible Notes to be repurchased plus accrued and unpaid interest, if any, to the

purchase date. In addition, if US Airways Group experiences a specified fundamental change, holders may require US Airways

Group to purchase for cash, shares or a combination thereof, at its election, all or a portion of their 7% Senior Convertible Notes,

subject to specified exceptions, at a price equal to 100% of the principal amount of the 7% Senior Convertible Notes plus accrued

and unpaid interest, if any, to the purchase date. Prior to October 5, 2010, the 7% Senior Convertible Notes will not be redeemable

at US Airways Group's option. US Airways Group may redeem all or a portion of the 7% Senior Convertible Notes at any time on

or after October 5, 2010, at a price equal to 100% of the principal amount of the 7% Senior Convertible Notes plus accrued and

unpaid interest, if any, to the redemption date if the closing price of US Airways Group's common stock has exceeded 115% of the

conversion price for at least 20 trading days in the 30 consecutive trading day period ending on the trading day before the date on

which US Airways Group mails the optional redemption notice.

103