US Airways 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281

|

|

Table of Contents

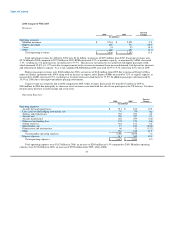

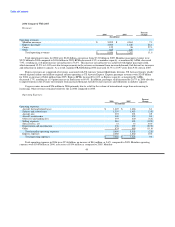

• Salaries and related costs per ASM decreased 33.5% primarily due to lower wage and benefits rates as a result of the cost-savings

agreements achieved with each of the collective bargaining groups, including the termination of defined benefit pension plans

and the curtailment of postretirement benefits, as well as lower headcount as compared to the same period in 2004.

• Aircraft maintenance per ASM increased 15.8% reflecting the shift to outside vendors to perform scheduled maintenance,

partially offsetting the decrease in salaries and related costs described above.

• Selling expenses per ASM decreased 7.4% primarily due to reduction in travel agent commissions, the termination of certain

marketing contracts and reductions in advertising programs as a result of the bankruptcy.

• Depreciation and amortization per ASM decreased 9.8% as a result of fewer owned aircraft in the operating fleet and lower book

values on the continuing fleet as a result of fresh-start reporting.

• Other operating expenses per ASM increased 7.9% primarily as a result of increases associated with the redemption of Dividend

Miles on partner airlines and future travel on US Airways as well as with outsourced aircraft cleaning services. These increases

were partially offset by decreases in insurance expense, outsourced technology services and schedule-related costs including

passenger food expenses.

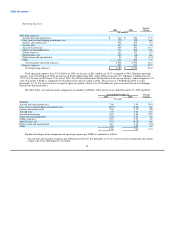

Express expenses increased 18.5% to $1.86 billion in 2005 as compared to 2004, reflecting a 14.8% increase in purchased ASMs,

increased flying by the former MidAtlantic division in 2005 and higher fuel prices that were paid by US Airways for US Airways Express

operations.

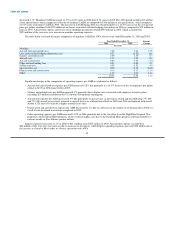

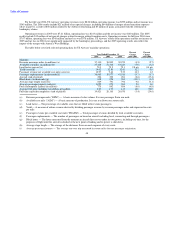

Nonoperating Income (Expense):

Percent

2005 2004 Change

(In millions)

Nonoperating income (expense)

Interest income $ 26 $ 12 nm

Interest expense, net (287) (236) 21.6

Reorganization items, net 636 (32) nm

Other, net (4) 19 nm

Total nonoperating income (expense) $ 371 $ (237) nm

US Airways had net nonoperating income of $371 million in 2005 compared to nonoperating expense of $237 million in 2004. The

change in nonoperating income (expense) is primarily a result of $636 million of net reorganization items representing amounts incurred

as a direct result of the Chapter 11 proceedings. See the description below for additional information on the components of reorganization

items. Interest income increased $14 million in 2005 as compared to 2004 due to higher cash balances, principally in the fourth quarter of

2005, and higher average interest rates on cash, cash equivalents and short-term investments. Interest expense increased $51 million as a

result of increased interest expense on the loan formerly guaranteed by the ATSB, including penalty interest incurred as a result of the

bankruptcy proceedings and interest associated with the purchase of new regional jets. The 2005 period included nonoperating expenses

of $4 million, which include foreign exchange losses and unfavorable mark-to-market adjustments on certain stock options held by

US Airways. The 2004 period includes $13 million related to a business interruption insurance recovery and a $2 million gain on the sale

of four aircraft.

53