US Airways 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

$161 million and $89 million. As described in further detail in Note 7, on March 31, 2006, the outstanding principal and accrued

interest on the $89 million loan was forgiven upon repayment in full of the $161 million loan in accordance with terms of the

Airbus loans. As a result, in 2006 the Company recognized a gain associated with the return of these equipment deposits upon

forgiveness of the loan totaling $90 million, consisting of the $89 million in equipment deposits and accrued interest of $1 million.

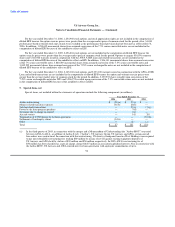

(b) In 2006, the Company incurred $131 million of merger related transition costs. These items include $41 million of personnel costs

for severance, retention payments and stock awards; $38 million of professional and technical fees; $17 million of aircraft livery

costs; $2 million in merger related aircraft lease return expenses; $6 million of training and related costs; $7 million of employee

moving expenses; $11 million of costs associated with the integration of the AWA FlightFund and US Airways Dividend Miles

frequent traveler programs; and $9 million of other expenses.

In 2005, the Company incurred $28 million of merger related transition costs in the fourth quarter of 2005 related to transitioning

the employees, systems and facilities of AWA and US Airways into one consolidated company. These items include insurance

premiums of $11 million related to policies for former officers and directors, compensation expense of $8 million for severance

and special stock awards granted under a program designed to retain key employees through the integration period, professional

and technical fees of $3 million, sales and marketing program expenses of $2 million related to notifying frequent traveler program

members about the merger, $1 million of aircraft livery costs, $1 million of programming service expense and $2 million in other

expenses.

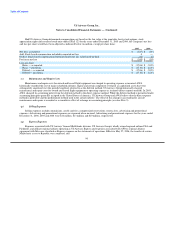

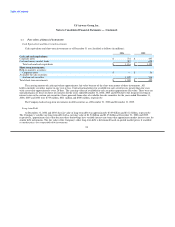

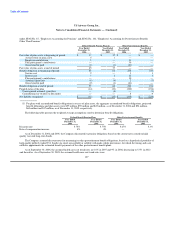

Severance charges and payment activity related to the merger are as follows:

Year Ended December 31,

2006 2005

Balance beginning of year $ 9 $ —

Amount recorded by US Airways in purchase accounting — 24

Severance expense 14 2

Payments (23) (17)

Balance end of year $ — $ 9

Due to the requirements for continued service, severance expense is recorded over the remaining service period. The Company

expects to record severance expense and make remaining termination and benefit payments of $1 million during 2007.

(c) In the third quarter of 2005, a $27 million loss was incurred related to the sale-leaseback of six Boeing 737-200 aircraft and two

Boeing 757 aircraft.

(d) In the fourth quarter of 2005, in connection with the return of certain leased aircraft, AWA incurred expenses of $7 million related

to penalties incurred under an outsourced maintenance arrangement.

(e) In the third and fourth quarter of 2005, AWA recorded severance expense totaling approximately $2 million for terminated

employees resulting from the merger.

(f) In August 2004, AWA entered into definitive agreements with two lessors to return six Boeing 737-200 aircraft. Three of these

aircraft were returned to the lessors in the third quarter of 2004, two were returned in the fourth quarter of 2004 and one was

returned in January 2005. In connection with the return of the aircraft, AWA recorded $2 million of special charges in 2004, which

included lease termination payments of $2 million and the write-down of leasehold improvements and aircraft rent balances of

$3 million, offset by the net reversal of lease return provisions of $3 million. In the first quarter of 2005, AWA recorded $1 million

in special charges related to the final Boeing 737-200 aircraft, which was removed from service in January 2005.

97