US Airways 2006 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

(f) Property and Equipment

Property and equipment are recorded at cost. Interest expenses related to the acquisition of certain property and equipment are

capitalized as an additional cost of the asset or as a leasehold improvement if the asset is leased. Interest capitalized for the year ended

December 31, 2006, the three months ended December 31, 2005, the nine months ended September 30, 2005 and the year ended

December 31, 2004 was $2 million, $300,000, $500,000, and $5 million respectively. Property and equipment is depreciated and

amortized to estimated residual values over the estimated useful lives or the lease term, whichever is less, using the straight-line method.

Costs of major improvements that enhance the usefulness of the asset are capitalized and depreciated over the estimated useful life of the

asset or the modifications, whichever is less.

Effective with the emergence from bankruptcy and the merger with America West Holdings, US Airways conformed its estimated

useful lives to those of America West Holdings. The estimated useful lives range from 3 to 12 years for owned property and equipment

and 18 to 30 years for training equipment and buildings. The estimated useful lives of owned aircraft, jet engines, flight equipment and

rotable parts range from 5 to 25 years. Leasehold improvements relating to flight equipment and other property or operating leases are

amortized over the life of the lease or the life of the asset, whichever is shorter. For periods prior to September 30, 2005, the estimated

useful lives for owned property and equipment ranged from 5 to 10 years, the estimated useful lives for training equipment and buildings

ranged from 10 to 30 years and the estimated useful lives of owned aircraft, jet engines, flight equipment and rotable parts ranged from 5

to 30 years.

US Airways records impairment losses on long-lived assets used in operations when events and circumstances indicate that the

assets might be impaired as defined by SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets"

("SFAS 144"). Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to

undiscounted future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to

be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be

disposed of are reported at the lower of the carrying amount or fair value less cost to sell. US Airways recorded no impairment charges in

the year ended December 31, 2006, the three months ended December 31, 2005, the nine months ended September 31, 2005 and the year

ended December 31, 2004.

(g) Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future

tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their

respective tax bases and operating loss and tax credit carryforwards. A valuation allowance is established, if necessary, for the amount of

any tax benefits that, based on available evidence, are not expected to be realized.

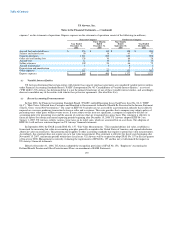

(h) Goodwill and Other Intangibles, Net

At December 31, 2006, goodwill represents the purchase price in excess of the net amount assigned to assets acquired and liabilities

assumed by America West Holdings on September 27, 2005. Since that time, there have been no events or circumstances that would

indicate an impairment to goodwill. US Airways performs its annual impairment test on October 1, unless events or changes indicate a

potential impairment in the carrying value. The provisions of SFAS No. 142, "Goodwill and Other Intangible Assets" ("SFAS 142")

require that a two-step impairment test be performed on goodwill. In the first step, the fair value of the reporting unit is compared to its

carrying value. If the fair value of the reporting unit exceeds the carrying value of the net assets of the reporting unit, goodwill is not

impaired and no further testing is required. If the carrying value of the net assets of the reporting unit exceeds the fair value of the

reporting unit, then a second step must be performed in order to determine the implied fair value of the goodwill and compare it to the

carrying value of the goodwill. If the carrying value of goodwill exceeds its implied fair value, then an impairment loss is recorded equal

to the difference. US Airways tested its

174