US Airways 2006 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

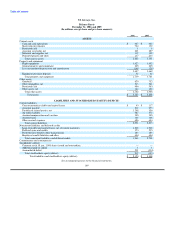

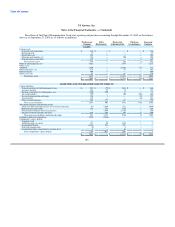

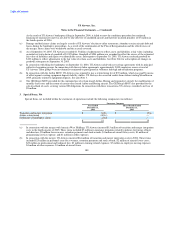

expenses" on the statements of operations. Express expenses on the statements of operations consist of the following (in millions):

Successor Company Predecessor Company

Three Months Nine Months

Year Ended Ended Ended Year Ended

December 31, December 31, September 30, December 31,

2006 2005 2005 2004

Aircraft fuel and related taxes $ 554 $ 140 $ 328 $ 206

Salaries and related costs 50 18 63 37

Capacity purchases 1,018 222 659 908

Other rent and landing fees 128 30 88 28

Aircraft rent 12 10 21 15

Selling expenses 109 24 66 72

Aircraft maintenance 2 3 9 1

Depreciation and amortization — — 7 3

Other expenses 187 43 131 302

Express expenses $ 2,060 $ 490 $ 1,372 $ 1,572

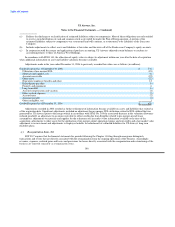

(r) Variable Interest Entities

US Airways determined that certain entities with which it has capacity purchase agreements are considered variable interest entities

under Financial Accounting Standards Board ("FASB") Interpretation No. 46 "Consolidation of Variable Interest Entities," as revised

("FIN 46(R)"). US Airways has determined that it is not the primary beneficiary of any of these variable interest entities, and accordingly,

does not consolidate any of the entities with which it has jet service agreements. (See also Note 8(c)).

(s) Recent Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board ("FASB") ratified Emerging Issues Task Force Issue No. 06-3 ("EITF

06-3"), "How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement

(That Is, Gross versus Net Presentation)." The scope of EITF 06-3 includes any tax assessed by a governmental authority that is directly

imposed on a revenue-producing transaction between a seller and a customer. This issue provides that a company may adopt a policy of

presenting taxes either gross within revenue or net. If taxes subject to this issue are significant, a company is required to disclose its

accounting policy for presenting taxes and the amount of such taxes that are recognized on a gross basis. This statement is effective to

financial reports for interim and annual reporting periods beginning after December 15, 2006. US Airways adopted EITF 06-3 on

January 1, 2007. US Airways collects various excise taxes on its ticket sales, which are accounted for on a net basis. The adoption of

EITF 06-3 will not have a material impact on US Airways' financial statements.

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements." This standard defines fair value, establishes a

framework for measuring fair value in accounting principles generally accepted in the United States of America, and expands disclosure

about fair value measurements. This pronouncement applies to other accounting standards that require or permit fair value measurements.

Accordingly, this statement does not require any new fair value measurement. This statement is effective for fiscal years beginning after

November 15, 2007, and interim periods within those fiscal years. US Airways will be required to adopt SFAS No. 157 in the first quarter

of fiscal year 2008. Management is currently evaluating the requirements of SFAS No. 157 and has not yet determined the impact on

US Airways' financial statements.

Effective December 31, 2006, US Airways adopted the recognition provisions of SFAS No. 158, "Employers' Accounting for

Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements

179