US Airways 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

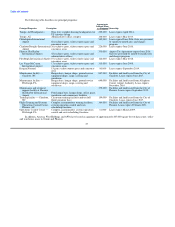

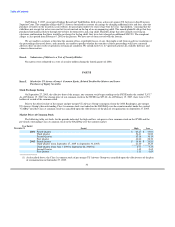

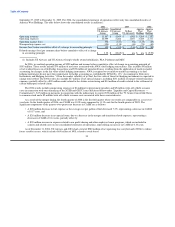

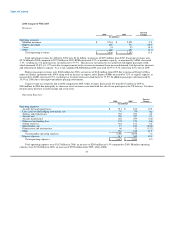

Balance Sheets (in millions):

Successor

Company(a) Predecessor Company(a)

December 31,

2006 2005 2004 2003 2002

Total assets $ 5,123 $ 4,808 $ 8,250 $ 8,349 $ 6,464

Long-term obligations(d) 1,787 2,493 4,815 4,591 5,009

Total stockholder's equity (deficit) 212 (133) (501) 89 (4,956)

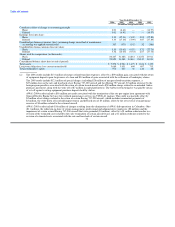

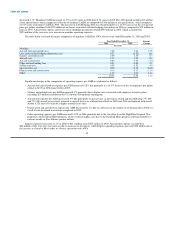

(a) In connection with emergence from the first bankruptcy in March 2003 and the second bankruptcy in September 2005,

US Airways adopted fresh-start reporting in accordance with AICPA Statement of Position 90-7, "Financial Reporting by Entities

in Reorganization Under the Bankruptcy Code." As a result of the application of fresh-start reporting, the financial statements

prior to March 31, 2003 are not comparable with the financial statements for the period April 1, 2003 to September 27, 2005, nor

is either period comparable to periods after September 27, 2005. References to "Successor Company" refer to US Airways on and

after September 27, 2005, after the application of fresh-start reporting for the second bankruptcy.

(b) The 2006 results include $64 million of merger related transition expenses, offset by a $40 million gain associated with the return

of equipment deposits upon forgiveness of a loan and $3 million of gains associated with the settlement of bankruptcy claims.

The operating results for the three months ended December 31, 2005 include $15 million in merger-related transition costs.

The operating results for the nine months ended December 31, 2003 include $212 million, net of amounts due to certain affiliates,

reduction in operating expenses in connection with the reimbursement for certain aviation-related security expenses in connection

with the Emergency Wartime Supplemental Appropriations Act and a $35 million charge in connection with US Airways'

intention not to take delivery of certain aircraft scheduled for future delivery.

The results for the year ended December 31, 2002 include a $392 million charge as a result of an impairment analysis conducted

on the B737-300, B737-400, B757-200 and B767-200 aircraft fleets as a result of changes to the aircraft's recoverability periods,

the planned conversion of owned aircraft to leased aircraft and indications of possible material changes to the market values of

these aircraft. The analysis revealed that estimated undiscounted future cash flows generated by these aircraft were less than their

carrying values for four B737-300s, 15 B737-400s, 21 B757-200s and three B767-200s. In accordance with SFAS No. 144,

"Accounting for the Impairment or Disposal of Long-Lived Assets," the carrying values were reduced to fair market value. The

2002 results also include a curtailment credit of $120 million related to certain postretirement benefit plans, a $30 million

curtailment charge related to certain defined benefit pension plans and an impairment charge of $21 million related to capitalized

gates at certain airports in accordance with SFAS No. 142, "Goodwill and Other Intangible Assets." The carrying values of the

affected gates were reduced to fair value based on a third-party appraisal.

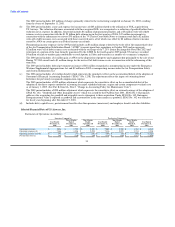

(c) In addition to the items discussed in note (b) above, net income (loss) reflects the following items for the periods indicated. The

year ended December 31, 2006 includes a non-cash expense for income taxes of $85 million related to the utilization of

$85 million of NOL acquired from US Airways. The release of the valuation allowance associated with these acquired NOL was

recognized as a reduction of goodwill rather than a reduction in tax expense.

The nine months ended September 30, 2005 and the year ended December 31, 2004 include reorganization items which amounted

to a $636 million net gain and a $32 million expense, respectively. The nine months ended December 31, 2003 include a

$30 million gain on the sale of US Airways' investment in Hotwire, Inc. In connection with US Airways' first bankruptcy, a

$1.89 billion gain and charges of $294 million attributable to reorganization items, net are included for the three months ended

March 31, 2003 and the year ended December 31, 2002, respectively.

34