US Airways 2006 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

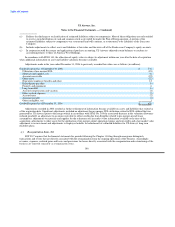

US Airways uses the "with-and-without" or "incremental" approach for determining the order in which tax benefits derived from the

share-based payment awards are utilized. Using the with-and-without approach, actual income taxes payable for the period are compared

to the amount of income taxes that would have been payable if there had been no share-based compensation expense for tax purposes in

excess of the compensation expense recognized for financial reporting purposes. As a result of this approach, tax net operating loss

carryforwards not related to share-based compensation are utilized before the current period's share-based compensation deduction. As a

result of this accounting treatment, US Airways has a fully reserved deferred tax asset of approximately $3 million related to tax net

operating loss carryforwards related to deductions for excess tax benefits. The benefit of the valuation allowance release related to these

deductions will be recorded directly to equity as additional paid-in-capital when such benefits are realized.

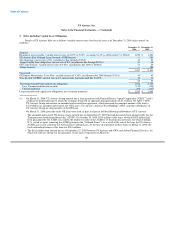

2. Emergence from Bankruptcy

(a) Emergence and Claims Resolution

On September 16, 2005, the Bankruptcy Court entered an order approving and confirming the Joint Plan of Reorganization of

US Airways, Inc. and Its Affiliated Debtors and Debtors-in-Possession (the "Plan of Reorganization"). The Plan of Reorganization

provides for a reorganization of each of the five Reorganized Debtors. In accordance with the Plan of Reorganization, US Airways Group

entered into a merger transaction with America West Holdings.

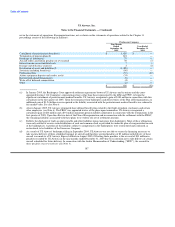

Initially, the equity of the new US Airways Group was allocated to three categories of holders. First, existing shares of America

West Holdings were converted into shares of common stock of US Airways Group. Second, the new equity investors received shares for

their initial investments and the exercise of their options. Third, unsecured creditors of the Reorganized Debtors have received or will

receive distributions totaling 8.2 million shares of the new common stock of US Airways Group in satisfaction of allowed unsecured

claims, including shares issued to the Pension Benefit Guaranty Corporation ("PBGC") and the Air Line Pilots Association ("ALPA").

The Plan of Reorganization classified claims into classes according to their relative seniority and other criteria and provides for the

treatment for each class of claims. Pursuant to the bankruptcy process, the Reorganized Debtors' claims agent received approximately

4,600 timely-filed proofs of claims as of the general bar date totaling approximately $26.4 billion in the aggregate, and approximately

530 proofs of claims timely-filed by governmental entities totaling approximately $13.6 billion in the aggregate. As of December 31,

2006, there are $472 million of unresolved claims. The ultimate resolution of certain of the claims asserted against the Reorganized

Debtors in the Chapter 11 cases will be subject to negotiations, elections and Bankruptcy Court procedures. The value of stock ultimately

distributed to any particular general unsecured creditor under the Plan of Reorganization will depend on a number of variables, including

the value of any claims filed by that creditor, the aggregate of all general unsecured claims and the value of shares of the new common

stock of US Airways Group in the marketplace at the time of distribution. The effects of these distributions were reflected in US Airways'

financial statements upon emergence and will not have any further impact on the results of operations.

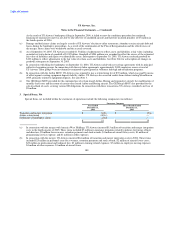

PBGC Claim — On November 12, 2004, US Airways filed a motion requesting a determination from the Bankruptcy Court that

US Airways satisfied the financial requirements for a "distress termination" under section 4041(c)(2)(B)(ii)(IV) of the Employee

Retirement Security Act of 1974, as amended ("ERISA"), of the Retirement Plan for Flight Attendants in the Service of US Airways, Inc.

("AFA Plan"), the Pension Plan for Employees of US Airways, Inc. Who Are Represented by the International Association of Machinists

and Aerospace Workers (the "IAM Plan"), and the Retirement Plan for Certain Employees of US Airways, Inc. (the "CE Plan"), as well

as approval of each plan's termination. These plans had aggregate benefit obligations of $2.71 billion and aggregate plan assets of

$1.76 billion, as of the plans' termination dates in January 2005. On January 6, 2005, the Bankruptcy Court entered an order (i) finding

that the financial requirements for a distress termination of the plans had been met and (ii) approving termination of the plans. The AFA

Plan and the IAM Plan were terminated effective January 10, 2005, which was the date agreed to by the PBGC and US Airways. The CE

181