US Airways 2006 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

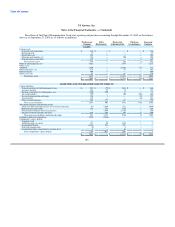

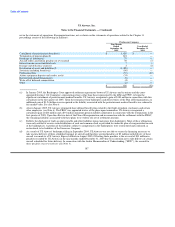

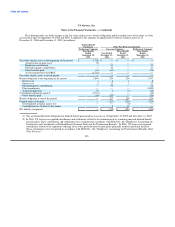

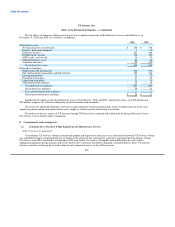

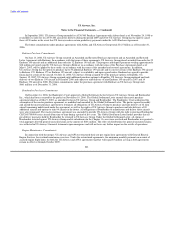

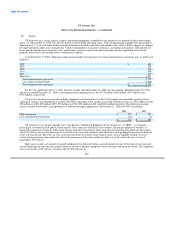

2006, the outstanding balance of the loan was $161 million. US Airways and AWA also had an $89 million loan from Airbus

Financial Services entered into as of September 27, 2005. In accordance with the terms of the loan agreements, the outstanding

principal amount of the $89 million loan was to be forgiven on the earlier of December 31, 2010 or the date that the outstanding

principal amount of, accrued interest on, and all other amounts due under the Airbus $161 million loan were paid in full,

provided that the US Airways Group complies with the delivery schedule for certain Airbus aircraft. As a result of the

prepayment of the $161 million loan on March 31, 2006, the $89 million loan agreement was terminated and the outstanding

balance of $89 million was forgiven.

(b) In September 2005, US Airways entered into an agreement to sell and leaseback certain of its commuter slots at Ronald Reagan

Washington National Airport and New York LaGuardia Airport. US Airways continues to hold the right to repurchase the slots

anytime after the second anniversary of the slot sale-leaseback transaction. These transactions were accounted for as secured

financings. Installments are due monthly through 2015 at a rate of 8%. In December 2006, Republic and US Airways modified

terms of the agreement to conform with subsequent regulatory changes at LaGuardia, and the slots were returned to US Airways.

The need for a subsequent modification was fully contemplated in the original agreement.

(c) Capital lease obligations consist principally of certain airport maintenance and facility leases which expire in 2018 and 2021.

(d) General Electric, together with its affiliates ("GE"), is US Airways Group's largest aircraft creditor, having financed or leased a

substantial portion of its aircraft prior to the most recent Chapter 11 filing. In June 2005, GE purchased the assets securing the

credit facility obtained from GE in 2001 (the "GE Credit Facility") in a sale-leaseback transaction. The sale proceeds realized from

the sale-leaseback transaction were applied to repay the liquidity facility obtained from GE in 2003 in connection with

US Airways' emergence from its first bankruptcy (the "2003 GE Liquidity Facility"), the mortgage financing associated with the

CRJ aircraft and a portion of the 2001 GE Credit Facility. The balance of the GECC Credit Facility was amended to allow

additional borrowings of $21 million in July 2005, which resulted in a total principal balance outstanding thereunder of

$28 million. The operating leases are cross-defaulted with all other GE obligations, other than excepted obligations, and are

subject to agreed upon return conditions. On March 31, 2006, the agreement was amended to change the maturity date from

September 30, 2010 to December 31, 2008 and required US Airways to make equal quarterly principal payments through maturity

beginning March 31, 2006.

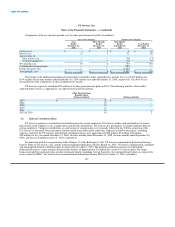

(e) In December 2004, deferred charges under US Airways' maintenance agreements with GE Engine Systems, Inc. were converted

into a $54 million unsecured term note. The original note balance of $54 million was reduced by a credit of $9.4 million as a result

of the merger. Interest on the note accrues at LIBOR plus 4%, and becomes payable beginning in January 2008, at which time

principal and interest payments are due in 48 monthly installments.

(f) In connection with US Airways Group's emergence from bankruptcy in September 2005, it reached a settlement with the PBGC

related to the termination of three of its defined benefit pension plans, which included the issuance of a $10 million note that

matures in 2012 and bears interest at 6% payable annually in arrears.

192