US Airways 2006 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

On February 26, 2004, a company called I.A.P. Intermodal, LLC filed suit against US Airways Group and its wholly owned airline

subsidiaries in the United States District Court for the Eastern District of Texas alleging that the defendants' computer scheduling system

infringes upon three patents held by plaintiffs, all of which patents are entitled, "Method to Schedule a Vehicle in Real-Time to Transport

Freight and Passengers." Plaintiff seeks various injunctive relief as well as costs, fees and treble damages. US Airways Group and its

subsidiaries were formally served with the complaint on June 21, 2004. On the same date, the same plaintiff filed what US Airways

Group believes to be substantially similar cases against nine other major airlines, including British Airways, Northwest Airlines

Corporation, Korean Airlines Co., Ltd., Deutsche Lufthansa AG, Air France, Air Canada, Singapore Airlines Ltd., Delta Air Lines and

Continental Airlines, Inc., and had filed a suit against AMR Group, Inc., the parent company of American Airlines, along with its airline

subsidiaries, in December 2003. This action has been stayed as to US Airways Group and its wholly owned subsidiaries as a result of the

2004 Bankruptcy. In the meantime, several foreign airline defendants were dismissed from the case for reasons unique to their status as

foreign operators, and the remaining defendants in September 2005 obtained a ruling that there had been no infringement of any of

I.A.P.'s patents. In October 2005, I.A.P. entered into consent judgments with several defendants. I.A.P. appealed the judgment in favor of

Continental Airlines and the AMR Group defendants, but the trial court's ruling was affirmed on November 13, 2006. No further appeals

have been taken. I.A.P. did not file any claims against US Airways Group or any of its subsidiaries in the 2004 Bankruptcy.

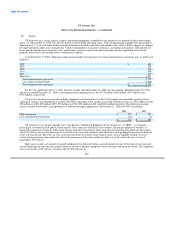

On January 7, 2003, the Internal Revenue Service ("IRS") issued a notice of proposed adjustment to US Airways Group proposing

to disallow $573 million of capital losses that US Airways Group sustained in the tax year 1999 on the sale of stock of USLM

Corporation (the "USLM matter"). On February 5, 2003, the IRS filed a proof of claim with the Bankruptcy Court in connection with the

bankruptcy case filed on August 11, 2002 (the "2002 Bankruptcy") asserting the following claims against US Airways with respect to the

USLM matter: (1) secured claims for U.S. federal income tax and interest of $1 million; (2) unsecured priority claims for U.S. federal

income tax of $68 million and interest of $14 million; and (3) an unsecured general claim for penalties of $25 million. On May 8, 2003,

US Airways Group reached a tentative agreement with the IRS on the amount of U.S. federal income taxes, interest and penalties due

subject to final approval from the Joint Committee on Taxation. By letter dated September 11, 2003, US Airways Group was notified that

the Joint Committee on Taxation had accepted the tentative agreement with the IRS, including a settlement of all federal income taxes

through the end of 2002. Due to the 2004 Bankruptcy filing, which suspended payment of prepetition liabilities, final payment terms

under the agreement have not been submitted to the Bankruptcy Court for approval. The IRS has submitted a proof of claim relating to

the USLM matter in the 2004 Bankruptcy in the amount of approximately $31 million, and on August 2, 2005 the IRS filed a motion for

relief from the automatic stay seeking to setoff against approximately $4 million of tax refunds due to the Reorganized Debtors. On

October 20, 2005, the IRS filed an amended proof of claim reducing its claim in the USLM matter to $11 million. On November 3, 2005,

the IRS filed an amended motion continuing to seek relief for the $4 million setoff. US Airways and the IRS have reached an agreement

to settle the USLM matter whereby the IRS would setoff approximately $4.5 million of tax refunds and the IRS would be allowed an

unsecured priority claim in the amount of approximately $6.5 million, payable within 30 days after the agreement is filed with the

Bankruptcy Court. The agreement was filed with the Bankruptcy Court on February 18, 2007 and the matter is now closed.

On February 8, 2006, 103 flight attendants employed by the former MidAtlantic division of US Airways filed a complaint against

the Association of Flight Attendants ("AFA"), AFA's international president Pat Friend and US Airways, alleging that defendants

conspired to deceive plaintiffs into believing that MidAtlantic was a separate entity from US Airways in order to deprive them of the

benefits they are due as US Airways flight attendants pursuant to the US Airways collective bargaining agreement. Plaintiffs' claims

against US Airways include breach of collective bargaining agreement, violation of the Railway Labor Act and racketeering under RICO.

Plaintiffs' complaint requests $400 million in damages from US Airways and injunctive relief. The complaint was served on US Airways

on July 7, 2006. On November 24, 2006, Plaintiffs filed with the district court a notice of voluntary dismissal of US Airways from the

litigation, and on November 27, 2006, US Airways filed a notice withdrawing its

204