US Airways 2006 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

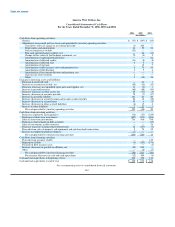

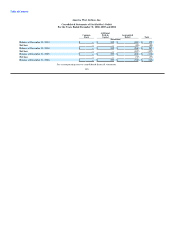

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

increases. These instruments primarily consist of costless collars which hedge approximately 29% of US Airways Group's 2007 total

anticipated jet fuel requirements as of December 31, 2006. AWA does not purchase or hold any derivative financial instruments for

trading purposes.

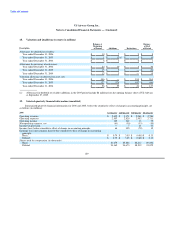

The weighted average collar ranges of the fuel hedges outstanding as of December 31, 2006 are as follows:

Put Option Call Option

Heating oil ($/gallon) $ 1.86 $ 2.06

Estimated Crude Oil Equivalent ($/barrel) $ 68.78 $ 77.18

SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities, as amended," ("SFAS 133") requires that all

derivatives be marked to market (fair value) and recorded on the balance sheet. Derivatives that are not hedges must be adjusted to fair

value through income.

As of December 31, 2006 and 2005, AWA had open fuel hedge positions in place, which do not currently qualify for hedge

accounting under SFAS 133. Accordingly, the derivative hedging instruments are recorded as an asset or liability on the balance sheet at

fair value and any changes in fair value are recorded as gains in fuel hedging instruments, net in operating expenses in the accompanying

consolidated statements of operations in the period of change. During 2006, 2005 and 2004, AWA recognized a net loss of $79 million

and net gains of $75 million and $24 million, respectively, related to hedging activities. The fair value of AWA's financial derivative

instruments at December 31, 2006 and 2005 was a net liability of approximately $66 million and a net asset of $4 million, respectively.

Since AWA's financial derivative instruments are not traded on a market exchange, the fair values are determined by the use of valuation

models with assumptions about commodity prices based on those observed in the underlying markets.

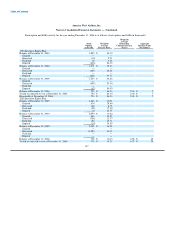

(k) Deferred Credits

Rents for operating leases were adjusted to fair market value when AWA emerged from bankruptcy in 1994. The net present value

of the difference between the stated lease rates and the fair market rates has been recorded as a deferred credit in the accompanying

balance sheets. The deferred credit will be decreased on a straight-line basis as a reduction in rent expense over the applicable lease

periods. At December 31, 2006 and 2005, the unamortized balance of the deferred credit was $30 million and $37 million, respectively.

In January 2002, AWA closed a $429 million loan supported by a $380 million government loan guarantee from the Air

Transportation Stabilization Board ("ATSB"). This loan triggered aircraft rent concessions negotiated with approximately 20 aircraft

lessors. Approximately $18 million of aircraft rent, which was accrued as of December 31, 2001, was waived by the aircraft lessors. This

amount has been recorded as a deferred credit in the accompanying consolidated balance sheets and is being amortized over the

remaining lives of the applicable leases as a reduction in rent expense. At December 31, 2006 and 2005, the unamortized balance of the

deferred credit was approximately $1 million and $3 million, respectively.

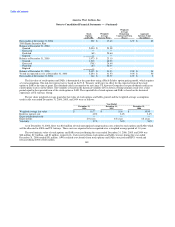

(l) Revenue Recognition

Passenger Revenue

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation that has not yet been provided are

initially recorded as air traffic liability on the balance sheet. The air traffic liability represents tickets sold for future travel dates and

estimated future refunds and exchanges of tickets sold for past travel dates. The majority of tickets sold are nonrefundable. Tickets that

are sold but not flown on the travel date may be reused for another flight, up to a year from the date of sale, or refunded, if the ticket is

refundable, after taking into account any cancellation penalties or change fees. A small percentage of tickets, or partially used tickets,

expire unused. Due to complex pricing structures, refund and exchange policies, and interline agreements with other airlines, certain

amounts are recognized in revenue using estimates regarding both the timing of the revenue recognition and the

139