US Airways 2006 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

of the co-branded credit card agreement with Juniper, until paid in full. US Airways Group makes monthly interest payments at

LIBOR plus 4.75% to Juniper, beginning on November 1, 2005, based on the amount of pre-purchased miles that have not been

used by Juniper in connection with the co-branded credit card program and have not been repurchased by US Airways Group.

US Airways Group will be required to repurchase pre-purchased miles under certain reductions in the collateral held under the

credit card processing agreement with JP Morgan Chase Bank, N.A. Accordingly, the prepayment has been recorded as additional

indebtedness.

Juniper requires US Airways Group to maintain an average quarterly balance of cash, cash equivalents and short-term investments

of at least $1 billion for the entirety of the agreement. Further, the agreement requires US Airways Group to maintain certain

financial ratios beginning January 1, 2006. Juniper may, at its option, terminate the amended credit card agreement, make

payments to US Airways Group under the amended credit card agreement in the form of pre-purchased miles rather than cash, or

require US Airways Group to repurchase the pre-purchased miles before the fifth year prior to the expiration date of the co-

branded credit card agreement with Juniper in the event that US Airways Group breaches its obligations under the amended credit

card agreement, or upon the occurrence of certain events.

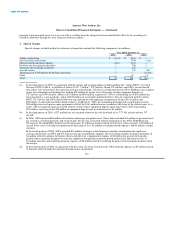

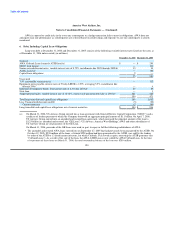

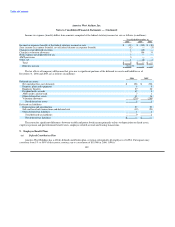

At December 31, 2006, the estimated maturities of long-term debt and capital leases are as follows (in millions):

2007 $ 2

2008 111

2009 139

2010 108

2011 —

Thereafter 29

$ 389

Certain of AWA's long-term debt agreements contain minimum cash balance requirements and other covenants with which AWA is

in compliance at December 31, 2006. Finally, AWA's long-term debt agreements contain cross-default provisions, which may be

triggered by defaults by AWA under other agreements relating to indebtedness.

Interest rates on $358 million principal amount of long-term debt as of December 31, 2006 are subject to adjustment to reflect

changes in floating interest rates. As of December 31, 2006, the weighted average effective interest rate was 9.98% for the variable rate

debt.

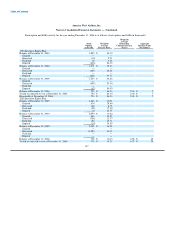

7. Commitments and Contingencies

(a) Commitments to Purchase Flight Equipment and Maintenance Services

Airbus Purchase Commitments

In August 2006, AWA amended its A320/A319 Purchase Agreement with Airbus to add seven new Airbus A321s to an existing

order for thirty A320 family aircraft. The amendment also converted one A320 aircraft and seven A319 aircraft to an order of eight A321

aircraft. Deliveries of the 15 new A321 aircraft will begin in 2008 and run through 2010. The new A321s will be configured to

accommodate up to 187 passengers in two classes of service and will be used for replacement purposes or modest expansion should

market conditions warrant.

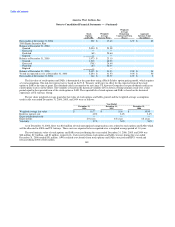

To modernize US Airways Group's international product and improve the efficiency of its international network, US Airways Group

was scheduled to begin accepting deliveries of Airbus A350 aircraft in 2011 pursuant to a purchase agreement that US Airways Group,

US Airways and AWA entered into in September 2005 with Airbus. US Airways Group has been notified that the A350 will be

undergoing significant design changes and will

153