US Airways 2006 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281

|

|

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

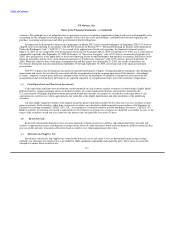

Cargo Revenue

Cargo revenue is recognized when shipping services for mail and other cargo are provided.

Other Revenue

Other revenue includes excess baggage charges, ticket change and service fees, commissions earned on tickets sold for flights on

other airlines, sales of tour packages by the US Airways Vacations division and the marketing component earned from selling mileage

credits to partners, as discussed in Note 1(j) "Frequent Traveler Programs".

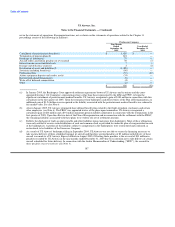

(n) Stock-based Compensation

Upon emergence from the first bankruptcy in March 2003, the Predecessor Company adopted the fair value method of recording

stock-based employee compensation contained in SFAS No. 123 "Accounting for Stock-Based Compensation" ("SFAS 123") and

accounted for this change in accounting principle using the "prospective method" as described by SFAS No. 148, "Accounting for Stock-

Based Compensation — Transition and Disclosure, an amendment of FASB Statement No. 123" ("SFAS 148"). Accordingly, the fair

values of all Predecessor Company stock option and warrant grants, as determined on the date of grant, were amortized as compensation

expense in the statements of operations over the vesting period. All stock options and warrants were cancelled upon emergence from the

second bankruptcy.

Effective with the emergence from bankruptcy and merger with America West Holdings, US Airways applied the provisions of

Accounting Principles Board ("APB") Opinion No. 25, "Accounting for Stock Issued to Employees" ("APB 25") and related

interpretations to account for awards of stock-based compensation granted to employees. If US Airways had applied the fair value based

recognition provisions of SFAS 123, stock-based compensation expense would have been $1 million greater for the three months ended

December 31, 2005.

Effective January 1, 2006, US Airways adopted SFAS No. 123R, "Share-Based Payment" ("SFAS 123R"), using the modified

prospective transition method. Under the modified prospective transition method, compensation cost is recognized in the financial

statements beginning with the effective date based on the requirements of SFAS 123R for all share-based payments granted after that

date, and based on the requirements of SFAS 123 for all unvested awards granted prior to the effective date of SFAS 123R. Results for

prior periods are not restated using the modified prospective transition method.

(o) Maintenance and Repair Costs

Maintenance and repair costs for owned and leased flight equipment are charged to operating expense as incurred.

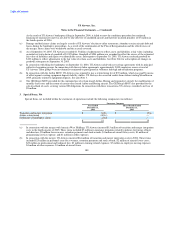

(p) Selling expenses

Selling expenses include commissions, credit card fees, computerized reservations systems fees and advertising and promotional

expenses. Advertising and promotional expenses are expensed when incurred. Advertising and promotional expenses for the year ended

December 31, 2006, the three months ended December 31, 2005, the nine months ended September 30, 2005, and the year ended

December 31, 2004 were $7 million, $1 million, $14 million, and $27 million, respectively.

(q) Express Expenses

Expenses associated with US Airways' former MidAtlantic division, US Airways Group's wholly owned regional airlines and

affiliate regional airlines operating as US Airways Express have been classified as "Express

178