US Airways 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

five Airbus A330 aircraft; and sales of other property and equipment. Restricted cash increased by $112 million in 2005 primarily due to

an increase in reserves required under an agreement for processing credit card transactions.

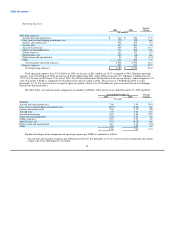

Net cash provided by financing activities was $276 million and $531 million in 2006 and 2005, respectively. Principal financing

activities in 2006 includes proceeds from the issuance of new debt totaling $1.4 billion, which included borrowings of $1.25 billion under

the new GE loan, a $64 million draw on one of the Airbus loans and $92 million of equipment notes issued to finance the acquisition of

three Boeing 757-200 and two Embraer 190 aircraft. Debt repayments totaled $1.2 billion and using the proceeds from the new GE loan,

included the repayment in full of the balances outstanding on our ATSB loans of $801 million, Airbus loans of $161 million, and two

GECC term loans of $110 million. We also made a $17 million payment related to the partial conversion of the 7% Senior Convertible

Notes. Principal financing activities in 2005 included the issuance of US Airways Group common stock for $732 million, and proceeds

from the issuance of debt totaling $655 million, which included a $325 million loan from an affinity credit card partner, $186 million

from the Airbus loans and $144 million from the issuance of the 7% Senior Convertible Notes. The debt repayments totaled $741 million

in 2005 and included a $433 million reduction in aircraft-related debt as a result of flight equipment asset sales and sale and leaseback

transactions, the GE debt repayment of $125 million, approximately $125 million in ATSB loan repayments, and the redemption of

AWA's 10.75% senior unsecured notes totaling $40 million.

AWA

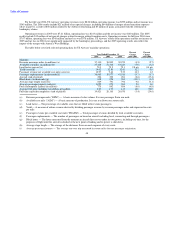

At December 31, 2006, AWA's total cash, cash equivalents, short-term investments and restricted cash balance was $1.3 billion, of

which $1.1 billion was unrestricted. Net cash provided by operating activities in 2006 was $293 million compared to net cash used in

operating activities of $24 million in 2005. The year-over-year increase in cash flows from operations of $317 million is primarily the

result of the decrease in net loss from $397 million in 2005, which included the non-cash cumulative effect of change in accounting

principle of $202 million, to $37 million in 2006. In addition, AWA air traffic liability (ticket sales for transportation that has not yet

been provided) increased $141 million in 2006 as compared to an increase of $23 million in 2005. The significant increase in air traffic

liability during 2006 is due principally to the integration of the AWA and US Airways web sites, as a result of which AWA incurs

additional air traffic liability by selling tickets for travel on US Airways.

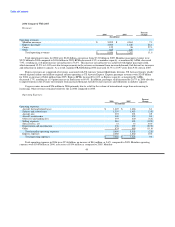

Net cash used in investing activities was $249 million and $283 million in 2006 and 2005, respectively. Principal investing

activities during 2006 included net purchases of short-term investments totaling $186 million and purchases of property and equipment

totaling $76 million, which includes costs to convert nine Boeing 757 aircraft to allow long-range over-water service and information

technology infrastructure costs such as upgraded computer equipment and software. Restricted cash decreased by $18 million during

2006 primarily due to a decrease in reserves required under agreements for processing AWA's credit card transactions. The 2005 period

included net purchases of short-term investments totaling $163 million, purchases of property and equipment totaling $37 million,

$74 million of net proceeds from the sale and leaseback of aircraft including six Boeing 737-300 and two Boeing 757-200 aircraft; and

sales of other property and equipment. Restricted cash increased by $157 million during 2005 due to an increase in cash reserves required

under an agreement for processing credit card transactions.

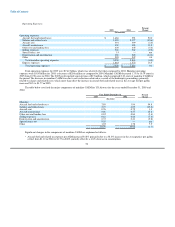

In 2006, net cash used in financing activities was $56 million, consisting principally of a decrease in the payable to affiliates

(primarily US Airways) of $52 million and $4 million of debt repayments. In 2005, net cash provided by financing activities was

$811 million, consisting principally of an increase in payable to related parties of $998 million. The increase in payable to related parties

reflects proceeds received in 2005 on behalf of US Airways Group from the merger-related financing transactions including the initial

equity investments, the public stock offering, the exercise of options by equity investors, the issuance of 7% Senior Convertible Notes

and the Airbus loans, net of cash retained by US Airways Group. Other 2005 financing activities included debt repayments of

$183 million, including principal repayments of $94 million for the government guaranteed loan, the redemption of 10.75% senior

unsecured notes totaling $40 million and the retirement of $39 million of equipment notes payable with the proceeds from the aircraft

sale and leaseback transaction discussed above.

56