Sallie Mae 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

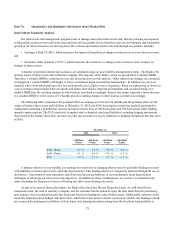

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Interest Rate Sensitivity Analysis

Our interest rate risk management program seeks to manage and control interest rate risk, thereby reducing our exposure

to fluctuations in interest rates and achieving consistent and acceptable levels of profit in any rate environment, and sustainable

growth in net interest income over the long term. We evaluate and monitor interest rate risk through two primary methods:

• Earnings at Risk (“EAR”), which measures the impact of hypothetical changes in interest rates on net interest income;

and

• Economic Value of Equity (“EVE”), which measures the sensitivity or change in the economic value of equity to

changes in interest rates.

A number of potential interest rate scenarios are simulated using our asset liability management system. The Bank is the

primary source of interest rate risk within the Company. The majority of the Bank’s assets are priced off of 1-month LIBOR.

Therefore, 1-month LIBOR is considered a core rate in our interest rate risk analysis. Other interest rate changes are correlated

to changes in 1-month LIBOR, with higher or lower correlations based on historical relationships. In addition, key rates are

modeled with a floor which indicates how low each specific rate is likely to move in practice. Rates are adjusted up or down via

a set of scenarios that includes both rate shocks and ramps. Rate shocks represent an immediate and sustained change in 1-

month LIBOR plus the resulting changes in other indexes correlated accordingly. Interest rate ramps represent a linear increase

in 1-month LIBOR over the course of 12 months plus the resulting changes in other indexes correlated accordingly.

The following tables summarize the potential effect on earnings over the next 24 months and the potential effect on fair

values of balance sheet assets and liabilities at December 31, 2015 and 2014, based upon a sensitivity analysis performed by

management assuming a hypothetical increase in market interest rates of 100 basis points and 300 basis points while funding

spreads remain constant. The EVE sensitivity is applied only to financial assets and liabilities, including hedging instruments

that existed at the balance sheet date, and does not take into account new assets, liabilities or hedging instruments that may arise

in 2016.

December 31,

2015 2014

+300 Basis

Points +100 Basis

Points +300 Basis

Points +100 Basis

Points

EAR - Shock . . . . . . . . 0.2 % 0.0 % +7.6 % +2.4 %

EAR - Ramp. . . . . . . . . 0.1 % 0.0 % +5.9 % +1.8 %

EVE . . . . . . . . . . . . . . . -3.0 % -1.3 % -2.7 % -1.5 %

A primary objective in our funding is to manage our sensitivity to changing interest rates by generally funding our assets

with liabilities of similar interest rate repricing characteristics. This funding objective is frequently obtained through the use of

derivatives. Uncertainty in loan repayment cash flows and the pricing behavior of our non-maturity retail deposits pose

challenges in achieving our interest rate risk objectives. In addition to these considerations, we can have a mismatch in the

index (including the frequency of reset) of floating rate debt versus floating rate assets.

As part of its suite of financial products, the Bank offers fixed-rate Private Education Loans. As with other Private

Education Loans, the term to maturity is lengthy, and the customer has the option to repay the loan faster than the promissory

note requires. Asset securitization provides long term fixed-rate funding for some of these assets. Additionally, a portion of the

fixed-rate loans have been hedged with derivatives, which have been used to convert a portion of variable rate funding to fixed-

rate to match the anticipated cash flows of these loans. Any unhedged position arising from the fixed-rate loan portfolio is