Sallie Mae 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257

|

|

77

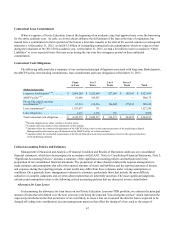

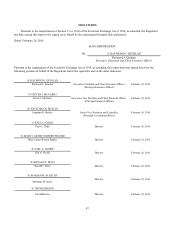

The data sharing agreement states the Bank will continue to have the right to obtain from Navient certain post-Spin-Off

performance data relating to Private Education Loans owned or serviced by Navient to support and facilitate ongoing

underwriting, originations, forecasting, performance and reserve analyses.

The tax sharing agreement governs the respective rights, responsibilities and obligations of the Company and Navient

after the Spin-Off relating to taxes, including with respect to the payment of taxes, the preparation and filing of tax returns and

the conduct of tax contests. Under this agreement, each party is generally liable for taxes attributable to its business. The

agreement also addresses the allocation of tax liabilities that are incurred as a result of the Spin-Off and related transactions.

Additionally, the agreement restricts the parties from taking certain actions that could prevent the Spin-Off from qualifying for

the anticipated tax treatment.

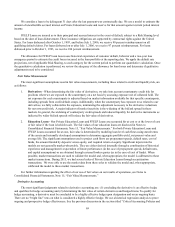

Amended Loan Participation and Purchase Agreement

Prior to the Spin-Off, the Bank sold substantially all of its Private Education Loans to several former affiliates, now

subsidiaries of Navient (collectively, the “Purchasers”), pursuant to this agreement. This agreement predates the Spin-Off but

has been significantly amended and reduced in scope in connection with the Spin-Off. Post-Spin-Off, the Bank retains only the

right to require the Purchasers to purchase loans (at fair value) for which the borrower also has a separate lending relationship

with Navient when the Split Loans either (1) are more than 90 days past due; (2) have been restructured; (3) have been granted

a hardship forbearance or more than 6 months of administrative forbearance; or (4) have a borrower or cosigner who has filed

for bankruptcy. At December 31, 2015, we held approximately $89 million of Split Loans.

During the year ended December 31, 2015, the Bank separately sold loans to the Purchasers in the amount of

$27.0 million in principal and $0.6 million in accrued interest income. During the year ended December 31, 2014, the Bank

separately sold loans to the Purchasers in the amount of $804.7 million in principal and $5.7 million in accrued interest income.

During the year ended December 31, 2013, the Bank sold loans to the Purchasers in the amount of $2,415.8 million in principal

and $67.0 million in accrued interest income.

There was no gain or loss resulting from loans sold to the Purchasers in the year ended December 31, 2015. The gain

resulting from loans sold to the Purchasers was $35.8 million and $196.6 million in the years ended December 31, 2014 and

2013, respectively. Total write-downs to fair value for loans sold with a fair value lower than par totaled $7.6 million,

$53.5 million and $68.4 million in the years ended December 31, 2015, 2014 and 2013, respectively. Navient is the servicer for

all of these loans.