Sallie Mae 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

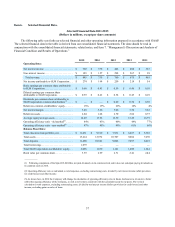

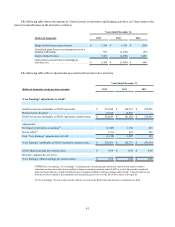

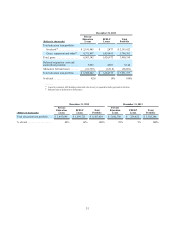

Private Education Loan Originations

Private Education Loans are the principal asset on our balance sheet, and the amount of new Private Education Loan

originations we generate each year is a key indicator of the trajectory of our business, including our future earnings and asset

growth.

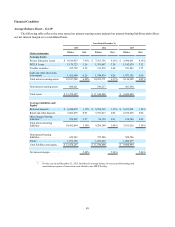

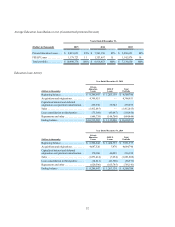

Funding Sources

Deposits

We utilize brokered, retail and other core deposits to meet funding needs and enhance our liquidity position. These

deposits can be term or liquid deposits. Term brokered deposits may have terms as long as seven years. Interest rates on most of

our long-term deposits are swapped into one-month LIBOR. This structure has the effect of matching our interest rate exposure

to the index our assets reset on, thereby minimizing our financing cost exposure to interest rate risk. Retail deposits are sourced

through a direct banking platform and serve as an important source of diversified funding. Brokered deposits are sourced

through a network of brokers and provide a stable source of funding. In addition, we accept certain deposits that are considered

non-brokered that are held in large accounts structured to allow FDIC insurance to flow through to underlying individual

depositors.

Loan Securitizations

We have diversified our funding sources by issuing term ABS and by entering into a Private Education Loan asset-backed

commercial paper facility (the “ABCP Facility”). Term ABS financing provides long-term funding for our Private Education

Loan portfolio at attractive interest rates and at terms that effectively match the average life of the assets. Loans associated with

these transactions will remain on our balance sheet if we retain the residual interest in these trusts. The ABCP Facility provides

an extremely flexible source of funds that can be drawn upon on short notice to meet funding needs within the Bank.

Borrowings under our ABCP Facility are accounted for as secured financings.

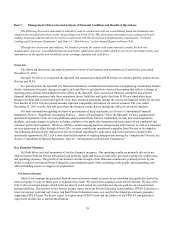

2015 Management Objectives

For 2015, we set out five major goals to create shareholder value. They were: (1) prudently grow Private Education Loan

assets and revenues; (2) maintain our strong capital position; (3) complete necessary steps to permit the Bank to independently

originate and service Private Education Loans; (4) continue to expand the Bank's capabilities and enhance risk oversight and

internal controls; and (5) manage operating expenses while improving efficiency and customer experience.

The following describes our performance relative to each of these goals.

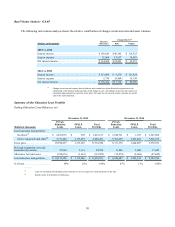

Prudently Grow Private Education Loan Assets and Revenues

We originated $4.3 billion in new Private Education Loans in 2015, compared with $4.1 billion in 2014, an increase of 6

percent. This growth in originations was accomplished while maintaining our FICO scores and cosigner rates on our 2015

originations at levels basically unchanged from those at which we ended 2014. The average origination FICO scores were 748

and 749, respectively, for originations made in the years ended December 31, 2015 and 2014. The cosigner rate was 90 percent

for originations made in the each of the years ended December 31, 2015 and 2014. In 2015, we expanded our campus-focused

sales force to provide deeper support for universities in all regions of the United States.

We also grew our revenues by selling $1.5 billion of Private Education Loans to third-parties. We recorded gains of

$135 million on those sales.

Our allowance for loan losses for Private Education Loans was $109 million at December 31, 2015, compared to

$79 million at the prior year-end. The provision expense on our Private Education Loans was $87 million for the year ended

December 31, 2015, compared to $84 million in 2014.