Sallie Mae 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

Enhance Customers' Experience By Further Improving Delivery of Products and Services

The Spin-Off provided us the opportunity to redesign our processes, procedures and customer experiences exclusively

around our Private Education Loan products, rather than accommodating the servicing of those products as well as FFELP and

Direct Student Loans serviced under direction of the Department of Education. In 2016, we will again focus on our new

servicing platform and processes to specifically target further simplifications regarding important transitions in the life cycle of

our customers’ Private Education Loan experience, including:

• Procedures followed and technology used by our customer service agents;

• Online functionality available to our customers; and

• Communications to our customers.

Sustain Consumer Protection Improvements Made Since the Spin-Off and Further Enhance Our Risk Oversight

Infrastructure

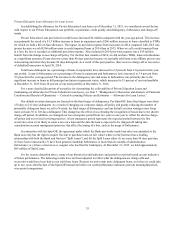

Since the Spin-Off, we have continued to undertake significant work to establish that all customer protection policies,

procedures and compliance management systems are sufficient to meet or exceed currently applicable regulatory standards. Our

redesigned SCRA processes and procedures have now received the approval of the DOJ and we expect all required restitution

activities under the FDIC Consent Order and DOJ Consent Order will be completed in 2016. In 2014, we engaged a third-party

firm to conduct independent audits of consumer protection processes and procedures, including our own compliance

management system. At this time, that engagement is ongoing and we are beginning our second full cycle of those audits. To

date, these audits have produced no high risk findings. Our goal is to sustain the improvements implemented to date and

consistently comply with or exceed regulatory standards while continuing to improve our customers’ experience and

satisfaction levels.

We must also further embed the Enterprise Risk Management disciplines throughout our organization and execute our

initial DFAST submission.

Successfully Launch One or More Complementary New Products to Increase Level of Engagement With Customers.

In 2015, our management team gave consideration to beginning to expand the suite of products we provide to

customers. Given our limited time and experience with our new originations platform and servicing capabilities, we prioritized

opportunities to focus first on those that can leverage our core competencies and capabilities, rather than require the

development or acquisition of new or alternative ones. For example, we will leverage our experience with our Smart Option

Student Loan products to launch a Parent Loan program designed for parents who wish to separately finance their children’s

education, rather than cosign loans with their children. We believe there is a market for this product that is separate from the

Smart Option Student Loan market, and we believe our product will be a competitive alternative to PLUS loans being offered

by the Department of Education. This product complements our portfolio of Private Education Loan offerings, but is not

expected to have a material impact on 2016 earnings.

We will also be exploring other product opportunities in 2016. In this process, we also place a high premium on designing

and launching products that will be easily understood and attractive to our customers. Any activity in 2016 will focus on

success of implementation, and we are not forecasting significant contributions to our originations, revenues or net income from

any potential new products in 2016.

Manage Operating Expenses While Improving Efficiency

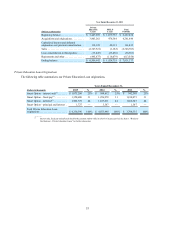

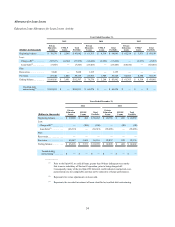

We will continue to measure our effectiveness in managing operating expenses by monitoring our efficiency ratio. Our

efficiency ratio will be calculated by dividing our total expenses, excluding restructuring costs and other reorganization

expenses, by net interest income (before provision for credit losses) and other income, excluding gains on sales of loans, net.

We expect this ratio to decline steadily over the next several years as the number of loans on which we earn either net interest

income or servicing revenue grows to a level commensurate with our loan origination platform and we control the growth of

our expense base.