Sallie Mae 2015 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

17. Regulatory Capital (Continued)

F-63

dividends to the Company as may be necessary to provide for regularly scheduled dividends payable on the Company’s Series

A and Series B Preferred Stock.

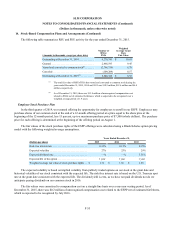

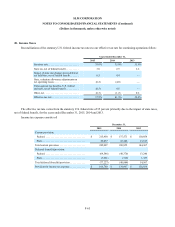

18. Defined Contribution Plans

We participate in a defined contribution plan which is intended to qualify under section 401(k) of the Internal Revenue

Code. The Sallie Mae 401(k) Savings Plan covers substantially all employees. After six months of service, effective January

2013, and after one year of service prior to that time, up to 3 percent of contributions are matched 100 percent with the next 2

percent matched at 50 percent for eligible employees. After one month of service, eligible employees receive a 1 percent core

employer contribution. For the years ended December 31, 2015, 2014 and 2013, we contributed $3.8 million, $3.1 million and

$2.8 million, respectively, to this plan.

19. Commitments, Contingencies and Guarantees

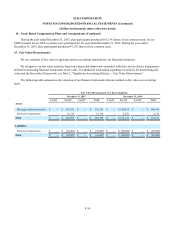

Commitments

When we approve a Private Education Loan at the beginning of an academic year, that approval may cover the borrowing

for the entire academic year. As such, we do not always disburse the full amount of the loan at the time of origination but

instead have a commitment to fund a portion of the loan at a later date (usually at the start of the second semester or subsequent

trimesters). At December 31, 2015, we had $1.5 billion of outstanding contractual loan commitments which we expect to fund

during the remainder of the 2015/2016 academic year. At December 31, 2015, we had a $2 million reserve recorded in "Other

Liabilities" to cover expected losses that may occur during the one year loss emergence period on these unfunded commitments.

Regulatory Matters

At the time of this filing, the Bank remains subject to the FDIC Consent Order. On May 13, 2014, the Bank reached

settlements with the FDIC and the DOJ regarding disclosures and assessments of certain late fees, as well as compliance with

the SCRA. Under the FDIC Consent Order, the Bank agreed to pay $3.3 million in fines and oversee the refund of up to $30

million in late fees assessed on loans owned or originated by the Bank since its inception in November 2005.

Under the terms of the Separation and Distribution Agreement between the Company and Navient, Navient is responsible

for funding all liabilities under the regulatory orders, other than fines directly levied against the Bank in connection with these

matters. Under the DOJ Consent Order, Navient is solely responsible for reimbursing SCRA benefits and related compensation

on behalf of both its subsidiary, Navient Solutions, Inc., and the Bank.

As required by the FDIC Consent Order and the DOJ Consent Order, the Bank has implemented new SCRA policies,

procedures and training, has updated billing statement disclosures, and is taking additional steps to ensure its third-party service

providers are also fully compliant in these regards. The FDIC Consent Order also requires the Bank to have its current

compliance with consumer protection regulations and its compliance management system audited by independent qualified

audit personnel. The Bank is focused on sustaining timely and comprehensive remediation of each item contained in the orders

and on further enhancing its policies and practices to promote responsible financial practices, customer experience and

compliance.

In May 2014, the Bank received a Civil Investigative Demand (“CID”) from the CFPB as part of the CFPB’s separate

investigation relating to customer complaints, fees and charges assessed in connection with the servicing of student loans and

related collection practices of pre-Spin-Off SLM by entities now subsidiaries of Navient during a time period prior to the Spin-

Off. Two state attorney generals have provided the Bank identical CIDs and others have become involved in the inquiry over

time. To the extent requested, we have been cooperating fully with the CFPB and the attorney generals but are not in a position