Sallie Mae 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

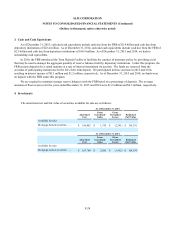

2. Significant Accounting Policies (Continued)

F-16

In fourth quarter 2015, we stopped selling defaulted loans to third-parties and began collecting on defaulted loans in-

house. It is our expectation that in the future we will continue to collect on defaulted loans in-house as well as sell defaulted

loans to third-parties. Prior to this change in practice, we only used estimates of what we would receive from the sale of

delinquent loans in estimating recoveries. For December, 31, 2015, we used both an estimate of recovery rates from in-house

collections as well as expectations of future sales of defaulted loans to estimate the timing and amount of future recoveries on

charged-off loans.

The roll rate analysis model is based upon actual experience using the 120 day charge-off default aversion strategies.

Once the quantitative calculation is performed, we review the adequacy of the allowance for loan losses and determine if

qualitative adjustments need to be considered.

In connection with the Spin-Off, the agreement under which the Bank previously made sales of defaulted loans to an

affiliate was amended so that the Bank now has the right to require Navient to purchase (at fair value) loans only where (a) the

borrower has a lending relationship with both the Bank and Navient (“Split Loans”) and (b) the Split Loans either (1) are more

than 90 days past due; (2) have been restructured; (3) have been granted a hardship forbearance or more than six months of

administrative forbearance; or (4) have a borrower or cosigner who has filed for bankruptcy. At December 31, 2015, we held

approximately $89 million of Split Loans.

Pre-Spin-Off SLM charged off loans when they were 212 days delinquent. As such, default aversion strategies were

focused on the final stages of delinquency, from 150 days to 212 days. In connection with the Spin-Off, we changed our charge-

off policy for Private Education Loans to charging off loans when they reach 120 days delinquent. As a result of changing our

corporate charge-off policy and greatly reducing the number of potentially delinquent loans we sell to Navient, our default

aversion strategies now focus on loans 30 to 120 days delinquent. This change has the effect of accelerating the recognition of

losses due to the shorter charge-off period (120 days). In addition, at the time of the Spin-Off, we changed our loss emergence

period from two years to one year to reflect the shorter charge-off policy and our revised servicing practices. These two

changes resulted in recognizing a $14 million net reduction in our allowance for loan losses in second quarter 2014 because we

are now only reserving for one year of losses as compared with two years under the prior policy, which more than offset the

impact of the shorter charge-off period.

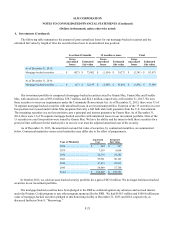

Troubled Debt Restructurings

Separately, for our TDR portfolio, we estimate an allowance amount sufficient to cover life-of-loan expected losses

through an impairment calculation based on the difference between the loan’s basis and the present value of expected future

cash flows (which would include life-of-loan default and recovery assumptions) discounted at the loan’s original effective

interest rate. Our TDR portfolio is comprised mostly of loans with interest rate reductions and forbearance usage greater than

three months.

We modify the terms of loans for certain borrowers when we believe such modifications may increase the ability and

willingness of a borrower to make payments and thus increase the ultimate overall amount collected on a loan. These

modifications generally take the form of a forbearance, a temporary interest rate reduction or an extended repayment plan. In

the first nine months after a loan enters full principal and interest repayment, the loan may be in forbearance for up to six

months without it being classified as a TDR. Once the initial nine-month period described above is over, however, any loan

that receives more than three months of forbearance in a twenty-four month period is classified as a TDR. Also, a loan becomes

a TDR when it is modified to reduce the interest rate on the loan (regardless of when such modification occurs and/or whether

such interest rate is temporary). The majority of our loans that are considered TDRs involve a temporary forbearance of

payments and do not change the contractual interest rate of the loan. Approximately 23 percent and 10 percent of the loans

granted forbearance as of December 31, 2015 and December 31, 2014, respectively, have been classified as TDRs due to their

forbearance status.