Sallie Mae 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

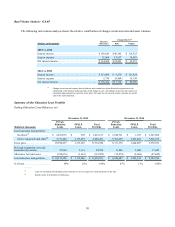

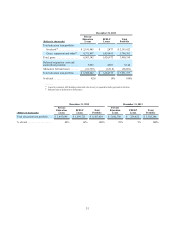

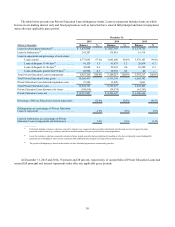

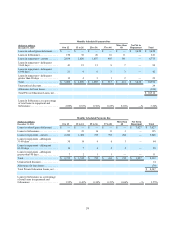

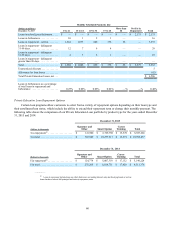

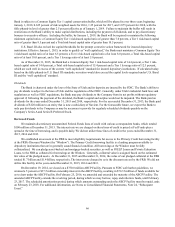

The following table summarizes changes in the allowance for Private Education Loan losses.

Years Ended December 31,

(Dollars in thousands) 2015 2014 2013 2012 2011

Allowance at beginning of period . . . . . . . . . . . . . . . . . . $ 78,574 $ 61,763 $ 65,218 $ 69,090 $ 49,738

Provision for Private Education Loan losses. . . . . . . . . . 87,344 83,583 64,955 62,447 85,037

Net charge-offs:

Charge-offs(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (55,357) (14,442) — — —

Recoveries. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,820 1,155 — — —

Net charge-offs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (49,537) (13,287) — — —

Loan sales(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,565) (53,485) (68,410) (66,319) (65,685)

Allowance at end of period . . . . . . . . . . . . . . . . . . . . . . . $ 108,816 $ 78,574 $ 61,763 $ 65,218 $ 69,090

Allowance as a percentage of ending total loans. . . . . . . 1.03% 0.95% 0.94% 1.18% 1.34%

Allowance as a percentage of ending total loans in

repayment(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.57% 1.53% 1.55% 1.74% 1.63%

Allowance coverage of net charge-offs. . . . . . . . . . . . . . 2.20 5.91 - - -

Net charge-offs as a percentage of average loans in

repayment(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.82% 0.30% - - -

Delinquencies as a percentage of ending loans in

repayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.23% 2.01% 0.99% 1.19% 1.70%

Loans in forbearances as a percentage of ending loans

in repayment and forbearance . . . . . . . . . . . . . . . . . . . . . 3.36% 2.56% 0.41% 0.24% 0.10%

Percentage of loans with a cosigner. . . . . . . . . . . . . . . . . 89.80% 89.82% 89.87% 89.81% 88.84%

Average FICO at origination . . . . . . . . . . . . . . . . . . . . . . 748 749 745 746 748

Ending total loans, gross . . . . . . . . . . . . . . . . . . . . . . . . . $10,596,437 $ 8,311,376 $ 6,563,342 $ 5,507,908 $ 5,172,369

Average loans in repayment(3) . . . . . . . . . . . . . . . . . . . . . $ 6,031,741 $ 4,495,709 $ 3,509,502 $ 3,928,692 $ 3,832,531

Ending loans in repayment(3) . . . . . . . . . . . . . . . . . . . . . . $ 6,927,266 $ 5,149,215 $ 3,972,317 $ 3,750,223 $ 4,249,703

_______

(1) Prior to the Spin-Off, we sold all loans greater than 90 days delinquent to an entity that is now a subsidiary of Navient Corporation, prior to being

charged-off. Consequently, many of the pre-Spin-Off, historical credit indicators and period-over-period trends are not comparable and may not be

indicative of future performance.

(2) Represents fair value adjustments on loans sold.

(3) Loans in repayment include loans on which borrowers are making interest only and fixed payments as well as loans that have entered full principal and interest

repayment status.

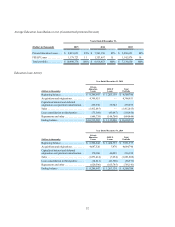

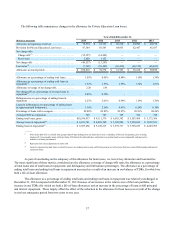

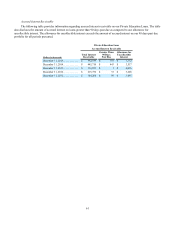

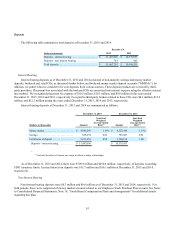

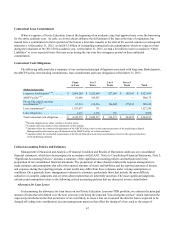

As part of concluding on the adequacy of the allowance for loan losses, we review key allowance and loan metrics.

The most significant of these metrics considered are the allowance coverage of charge-offs ratio; the allowance as a percentage

of total loans and of total loans in repayment; and delinquency and forbearance percentages. The allowance as a percentage of

ending total loans and ending total loans in repayment increased as a result of an increase in our balance of TDRs, for which we

hold a life-of-loan allowance.

The allowance as a percentage of ending total loans and ending total loans in repayment was relatively unchanged at

December 31, 2014 compared with December 31, 2013 because of an increase in the relative size of the loan portfolio, an

increase in our TDRs (for which we hold a life-of-loan allowance) and an increase in the percentage of loans in full principal

and interest repayment. These largely offset the effect of the reduction in the allowance for loan losses as a result of the change

in our loss emergence period from two years to one year.