Sallie Mae 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257

|

|

8

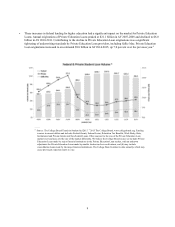

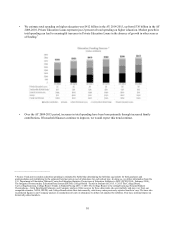

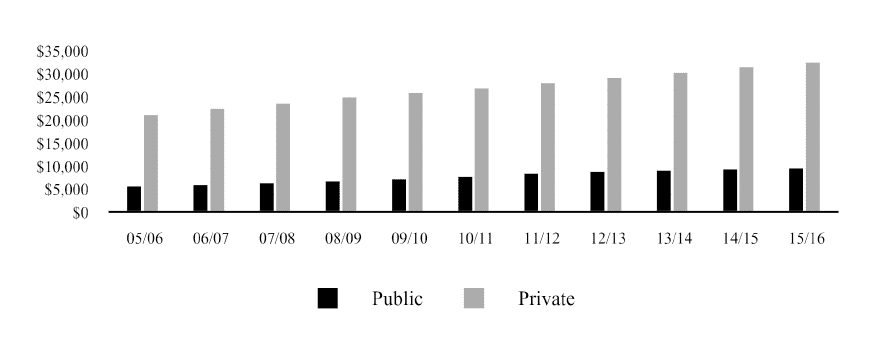

Tuition Rates

• Average published tuition and fees (exclusive of room and board) at four-year public and private not-for-profit

institutions increased at compound annual growth rates of 5.5 percent and 4.4 percent, respectively, from AYs

2005-2006 through 2015-2016. Growth rates have been more modest the last two AYs, with average published tuition

and fees at public and private four-year not-for-profit institutions increasing 2.9 percent and 3.8 percent, respectively,

between AYs 2013-2014 and 2014-2015 and 2.9 percent and 3.6 percent, respectively, between AYs 2014-2015 and

2015-2016.3 Tuition and fees are likely to continue to grow at the more modest rates of recent years.

Published Tuition and Fees3

(Dollars in actuals)

______

3 Source: The College Board-Trends in College Pricing 2015. © 2015 The College Board.

www.collegeboard.org. The College Board restates its data annually, which may cause

previously reported results to vary.

Sources of Funding

• Borrowing through federal education loan programs increased at a compound annual growth rate of 10 percent

between AYs 2004-2005 and 2011-2012.6 Federal borrowing increased considerably during the recession, with

borrowing increasing 26 percent between AYs 2007-2008 and 2008-2009 alone. A major driver of this activity was the

Higher Education Reconciliation Act of 2005, which in AY 2007-2008 raised annual Stafford loan limits for the first

time since 1992 and expanded federal lending with the introduction of the Graduate PLUS loan. In response to the

financial crisis in AY 2008-2009, The Ensuring Continued Access to Student Loans Act of 2008 raised unsubsidized

Stafford loan limits for undergraduate students again by $2,000.4 Federal education loan program borrowing peaked in

AY 2011-2012. Since then it declined by 4 percent in AY 2012-2013, 1 percent in AY 2013-2014, and another 5

percent in AY 2014-2015. We believe these declines are principally driven by enrollment declines in the for-profit

schools sector.4 Between AYs 2004-2005 and 2014-2015, federal grants increased 164 percent to $46.2 billion.5

_________________________

4 Source: FinAid, History of Student Financial Aid and Historical Loan Limits. © 2014 by FinAid. www.FinAid.org.

5 Source: The College Board-Trends in Student Aid 2015. © 2015 The College Board. www.collegeboard.org.