Sallie Mae 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

F-13

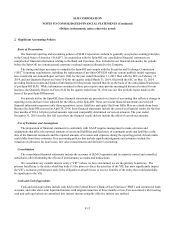

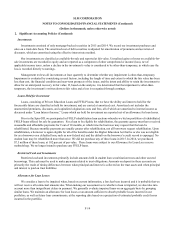

2. Significant Accounting Policies

Basis of Presentation

The financial reporting and accounting policies of SLM Corporation conform to generally accepted accounting principles

in the United States of America (“GAAP”). In conjunction with the Spin-Off, our consolidated financial statements are

comprised of financial information relating to the Bank and Upromise. Also included in our financial statements, for periods

before the Spin-Off, are certain general corporate overhead expenses allocated to the Company.

The timing and steps necessary to complete the Spin-Off and comply with the Securities and Exchange Commission

(“SEC”) reporting requirements, including the replacement of pre-Spin-Off SLM with our current publicly traded registrant,

have resulted in our Annual Report on Form 10-K for the year ended December 31, 2013 filed with the SEC on February 19,

2014, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, filed with the SEC on May 12, 2014,

providing business results and financial information for the periods reported therein on the basis of the consolidated businesses

of pre-Spin-Off SLM. While information contained in those prior reports may provide meaningful historical context for our

business, the Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 was our first periodic report made on the

basis of the post-Spin-Off business.

For periods before the Spin-Off, these financial statements are presented on a basis of accounting that reflects a change in

reporting entity and have been adjusted for the effects of the Spin-Off. These carved-out financial statements and selected

financial information represent only those operations, assets, liabilities and equity that form Sallie Mae on a stand-alone basis.

Because the Spin-Off occurred on April 30, 2014, these financial statements include the carved-out financial results for the first

four months of 2014. All prior period amounts represent comparably determined carved-out amounts. The year ended

December 31, 2015 was the first full year where the financial results did not include the effect of carved-out amounts.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the

date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could differ from those estimates. Key accounting policies that include significant judgments and estimates include the

valuation of allowance for loan losses, fair value measurements and derivative accounting.

Consolidation

The consolidated financial statements include the accounts of SLM Corporation and its majority-owned and controlled

subsidiaries after eliminating the effects of intercompany accounts and transactions.

We consolidate any variable interest entity (“VIE”) where we have determined we are the primary beneficiary. The

primary beneficiary is the entity which has both: (1) the power to direct the activities of the VIE that most significantly impact

the VIE’s economic performance and (2) the obligation to absorb losses or receive benefits of the entity that could potentially

be significant to the VIE.

Cash and Cash Equivalents

Cash and cash equivalents include cash held in the Federal Reserve Bank of San Francisco (“FRB”) and commercial bank

accounts, and other short-term liquid instruments with original maturities of three months or less. Fees associated with investing

cash and cash equivalents are amortized into interest income using the effective interest rate method.