Sallie Mae 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

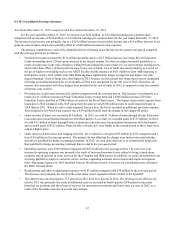

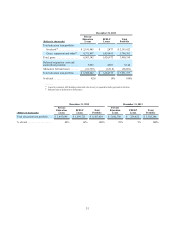

Maintain Our Strong Capital Position

The Bank is required by its regulators, the UDFI and the FDIC, to maintain sufficient capital to support its assets and

operations. At December 31, 2015, the Bank had a Common Equity Tier 1 risk-based capital ratio of 14.4 percent, a Tier 1 risk-

based capital ratio of 14.4 percent, a Total risk-based capital ratio of 15.4 percent, and a Tier 1 leverage ratio of 12.3 percent,

which are each well in excess of the current “well-capitalized” standard for insured depository institutions and in line with the

levels established by the Bank's Board of Directors. For a further discussion of regulatory capital requirements, see Item 7,

“Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources

— Regulatory Capital” in this Form 10-K for the year ended December 31, 2015. We were able to successfully support our

capital levels, in part, through active participation in the capital markets during 2015, our first full year since the Spin-Off.

Complete Necessary Steps to Permit the Bank to Independently Originate and Service Private Education Loans

In 2015, we implemented the final phase of the Bank’s new loan origination platform and are now processing all of our

new loan originations through this platform. At the time of this filing, the Bank continues to rely on Navient for disbursement

capabilities and for limited loan origination capabilities provided under agreements entered into with Navient in connection

with the Spin-Off. The year ended December 31, 2015 also was the first full year in which we serviced all of our Private

Education Loans with our own post-Spin-Off personnel and platforms. After the Spin-Off, the Bank typically sold charged-off

loans to third-parties for collection. In the latter half of 2015, however, the Bank developed the ability to retain and collect those

loans using its own personnel. We now consider our operational separation from Navient to be complete.

Continue to Expand the Bank’s Capabilities and Enhance Risk Oversight and Internal Controls

In 2015, we undertook significant work to establish that all functions, policies and procedures transferred to the Bank in

the Spin-Off are sufficient to meet applicable bank and consumer protection regulatory standards. For 2015, we continued,

completed or launched the following key initiatives:

• Completed the adoption of the Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring

Organizations of the Treadway Commission (“COSO”) with respect to our internal controls over financial reporting.

• Continued the build-out of our Enterprise Risk Management (“ERM”) program and established the foundation for our

2016 Dodd-Frank Act Stress Testing (“DFAST”) submission and, in connection therewith, took steps to enhance our

model risk management process.

• Implemented a new enterprise-wide governance framework and launched a manager’s risk and control self -

assessment methodology.

• Strengthened our Internal Audit function by adding eight additional professional staff, implementing several new

automated systems, and significantly increasing the professional certifications of Internal Audit's staff members. We

also received a favorable opinion from an independent accounting firm engaged to conduct an external quality

assessment of the Internal Audit function, in accordance with internal audit industry standards.

• Made changes and enhancements to our compliance management system and program and related consumer protection

processes and procedures. Our redesigned SCRA process and procedures have now received the approval of the DOJ.

In 2014, we engaged a third-party firm to conduct independent audits of consumer protection processes and

procedures, including our own compliance management system. At this time, that engagement is ongoing and we are

beginning our second full cycle of those audits. To date, we have received no high-risk findings.

Manage Operating Expenses While Improving Efficiency and Customer Experience

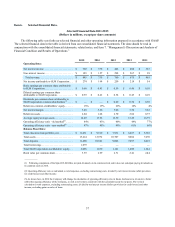

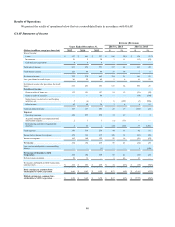

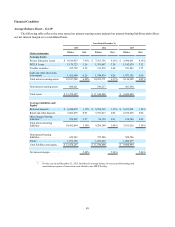

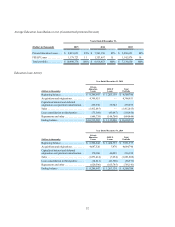

Operating expenses, excluding restructuring and other reorganization expenses, were $351 million for the year ended

December 31, 2015, as compared with $278 million for the prior year. Restructuring and other reorganization expenses were

$5 million for the year ended December 31, 2015, compared with $38 million for the year ended December 31, 2014.

In 2015, we completed the implementation of our new loan originations platform, moved all customer service for our

Private Education Loan portfolio back to the United States, and implemented upgrades and improvements to our mobile and

loan management capabilities. On-shoring all Private Education Loan customer service and enhancing our mobile capabilities

represent significant investments to enhance the overall customer experience and deliver to our customers the access they