Sallie Mae 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3

PART I.

Item 1. Business

Company History

SLM Corporation, more commonly known as Sallie Mae, is the nation’s leading saving, planning and paying for

education company. For 43 years, we have made a difference in students’ and families’ lives, helping more than 34 million

Americans pay for college. We recognize there is no single way to achieve this task, so we provide a range of products to help

families, whether college is a long way off or right around the corner. We promote responsible financial habits that help our

customers dream, invest and succeed.

Our primary business is to originate and service Private Education Loans we make to students and their families. We use

“Private Education Loans” to mean education loans to students or their families that are not made, insured or guaranteed by any

state or federal government. We also operate a consumer savings network that provides financial rewards on everyday

purchases to help families save for college.

We were formed in 1972 as the Student Loan Marketing Association, a federally chartered government sponsored

enterprise (“GSE”), with the goal of furthering access to higher education by providing liquidity to the education loan

marketplace. Under privatization legislation passed in 1997, we incorporated SLM Corporation as a Delaware corporation with

the GSE as a subsidiary and on December 29, 2004, we terminated the federal charter and dissolved the GSE.

On April 30, 2014, we completed our plan to legally separate (the “Spin-Off”) into two distinct publicly traded entities: an

education loan management, servicing and asset recovery business, named Navient Corporation (“Navient”); and a consumer

banking business, named SLM Corporation. We sometimes refer to the SLM Corporation that existed prior to the Spin-Off as

“pre-Spin-Off SLM” herein.

Our principal executive offices are located at 300 Continental Drive, Newark, Delaware 19713, and our telephone number

is (302) 451-0200.

Our Business

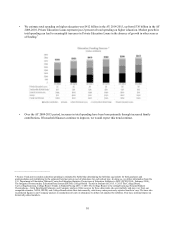

Our primary business is to originate and service Private Education Loans. In 2015, we originated $4.3 billion of Private

Education Loans, an increase of 6 percent from the year ended December 31, 2014. As of December 31, 2015, we had

$10.5 billion of Private Education Loans outstanding.

Private Education Loans

The Private Education Loans we make to students and families are primarily to bridge the gap between the cost of higher

education and the amount funded through financial aid, federal loans and customers’ resources. We also extend Private

Education Loans as an alternative to similar federal education loan products where we believe our rates are competitive. We

earn interest income on our Private Education Loan portfolio, net of provision for loan losses.

In 2009, we introduced the Smart Option Student Loan, our Private Education Loan product emphasizing in-school

payment features that can produce shorter terms to minimize customers’ total finance charges. Customers elect one of three

Smart Option repayment types at the time of loan origination. The first two, Interest Only and Fixed Payment options, require

monthly payments while the student is in school and for six months thereafter, and accounted for approximately 56 percent of

the Private Education Loans Sallie Mae Bank originated during 2015. The third repayment option is the more traditional

deferred Private Education Loan product where customers are not required to make payments while the student is in school and

for a six-month grace period after separation. Lower interest rates on the Interest Only and Fixed Payment options incentivize

customers to elect those options. Having borrowers make payments while in school helps reduce the total loan cost compared

with the traditional deferred loan, and also helps borrowers become accustomed to making on-time regular loan payments.

We regularly review and update the terms of our Private Education Loan products. Our Private Education Loans include

important protections for the family, including loan forgiveness in case of death or permanent disability of the student borrower

and a free, quarterly FICO Score benefit to students with a Smart Option Student Loan disbursed since academic year

2014-2015.