Sallie Mae 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

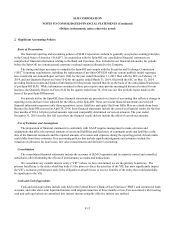

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

2. Significant Accounting Policies (Continued)

F-17

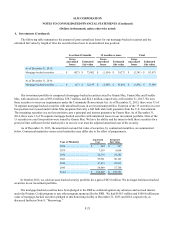

Key Credit Quality Indicators

We determine the collectability of our Private Education Loan portfolio by evaluating certain risk characteristics. We

consider credit score, existence of a cosigner, loan status and loan seasoning as the key credit quality indicators because they

have the most significant effect on the determination of the adequacy of our allowance for loan losses. Credit scores are an

indicator of the creditworthiness of a borrower and the higher the credit score the more likely it is the borrower will be able to

make all of their contractual payments. Loan status affects the credit risk because a past due loan is more likely to result in a

credit loss than an up-to-date loan. Additionally, loans in the deferred payment status have different credit risk profiles

compared with those in current pay status. Loan seasoning affects credit risk because a loan with a history of making payments

generally has a lower incidence of default than a loan with a history of making infrequent or no payments. The existence of a

cosigner lowers the likelihood of default. We monitor and update these credit quality indicators in the analysis of the adequacy

of our allowance for loan losses on a quarterly basis.

Certain Private Education Loans do not require borrowers to begin repayment until six months after they have graduated

or otherwise left school. Consequently, the loss estimates for these loans is generally low while the borrower is in school. At

December 31, 2015 and 2014, 32 percent and 36 percent, respectively, of the principal balance in the Private Education Loan

portfolio was related to borrowers who are in an in-school (fully deferred), grace, or deferment status and not required to make

payments. As this population of borrowers leaves school, they will be required to begin payments on their loans, and the

allowance for losses may change accordingly.

Similar to the rules governing FFELP payment requirements, our collection policies allow for periods of nonpayment for

borrowers requesting additional payment grace periods upon leaving school or experiencing temporary difficulty meeting

payment obligations. This is referred to as forbearance status and is considered separately in the allowance for loan losses. The

loss emergence period is in alignment with the typical collection cycle and takes into account these periods of nonpayment.

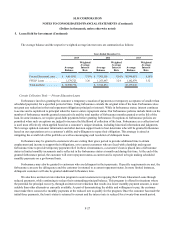

As part of concluding on the adequacy of the allowance for loan loss, we review key allowance and loan metrics. The

most relevant of these metrics considered are the allowance coverage of charge-offs ratio; the allowance as a percentage of total

loans and of loans in repayment; and delinquency and forbearance percentages.

We consider a loan to be delinquent 31 days after the last payment was contractually due. We use a model to estimate the

amount of uncollectible accrued interest on Private Education Loans and reserve for that amount against current period interest

income.

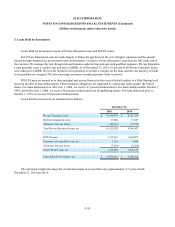

Allowance for FFELP Loan Losses

FFELP Loans are insured as to their principal and accrued interest in the event of default subject to a Risk Sharing level

based on the date of loan disbursement. These insurance obligations are supported by contractual rights against the United

States. For loans disbursed on or after July 1, 2006, we receive 97 percent reimbursement. For loans disbursed after October 1,

1993, and before July 1, 2006, we receive 98 percent reimbursement on all qualifying default claims. For loans disbursed prior

to October 1, 1993, we receive 100 percent reimbursement.

The allowance for FFELP Loan losses uses historical experience of customer default behavior and a two-year loss

emergence period to estimate the credit losses incurred in the loan portfolio at the reporting date. We apply the default rate

projections, net of applicable Risk Sharing, to each category for the current period to perform our quantitative calculation. Once

the quantitative calculation is performed, we review the adequacy of the allowance for loan losses and determine if qualitative

adjustments need to be considered.