Sallie Mae 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

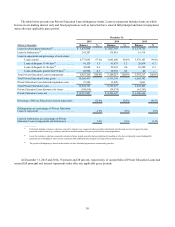

Bank is subject to a Common Equity Tier 1 capital conservation buffer, which will be phased in over three years beginning

January 1, 2016: 0.625 percent of risk-weighted assets for 2016, 1.25 percent for 2017, and 1.875 percent for 2018, with the

fully phased-in level of greater than 2.5 percent effective as of January 1, 2019. Failure to maintain the buffer will result in

restrictions on the Bank’s ability to make capital distributions, including the payment of dividends, and to pay discretionary

bonuses to executive officers. Including the buffer, by January 1, 2019, the Bank will be required to maintain the following

minimum capital ratios: a Common Equity Tier 1 risk-based capital ratio of greater than 7.0 percent, a Tier 1 risk-based capital

ratio of greater than 8.5 percent and a Total risk-based capital ratio of greater than 10.5 percent.

U.S. Basel III also revised the capital thresholds for the prompt corrective action framework for insured depository

institutions. Effective January 1, 2015, in order to qualify as “well capitalized,” the Bank must maintain a Common Equity Tier

1 risk-based capital ratio of at least 6.5 percent, a Tier 1 risk-based capital ratio of at least 8.0 percent, a Total risk-based capital

ratio of at least 10.0 percent, and a Tier 1 leverage ratio of at least 5.0 percent.

As of December 31, 2015, the Bank had a Common Equity Tier 1 risk-based capital ratio of 14.4 percent, a Tier 1 risk-

based capital ratio of 14.4 percent, a Total risk-based capital ratio of 15.4 percent and a Tier 1 leverage ratio of 12.3 percent,

which are each well in excess of the current “well capitalized” standard for insured depository institutions. If calculated today

based on the fully phased-in U.S. Basel III standards, our ratios would also exceed the capital levels required under U.S. Basel

III and the “well capitalized” standard.

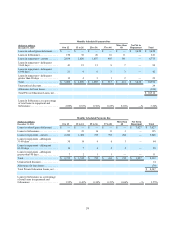

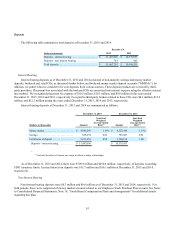

Dividends

The Bank is chartered under the laws of the State of Utah and its deposits are insured by the FDIC. The Bank’s ability to

pay dividends is subject to the laws of Utah and the regulations of the FDIC. Generally, under Utah’s industrial bank laws and

regulations as well as FDIC regulations, the Bank may pay dividends to the Company from its net profits without regulatory

approval if, following the payment of the dividend, the Bank’s capital and surplus would not be impaired. The Bank paid no

dividends for the years ended December 31, 2015 and 2014, respectively. For the year ended December 31, 2013, the Bank paid

dividends of $120 million to an entity that is now a subsidiary of Navient. For the foreseeable future, we expect the Bank to

only pay dividends to the Company as may be necessary to provide for regularly scheduled dividends payable on the

Company’s Series A and Series B Preferred Stock.

Borrowed Funds

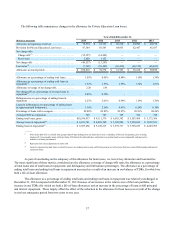

We maintain discretionary uncommitted Federal Funds lines of credit with various correspondent banks, which totaled

$100 million at December 31, 2015. The interest rate we are charged on these lines of credit is priced at Fed Funds plus a

spread at the time of borrowing, and is payable daily. We did not utilize these lines of credit in the years ended December 31,

2015, 2014 and 2013.

We established an account at the FRB to meet eligibility requirements for access to the Primary Credit borrowing facility

at the FRB’s Discount Window (the “Window”). The Primary Credit borrowing facility is a lending program available to

depository institutions that are in generally sound financial condition. All borrowings at the Window must be fully

collateralized. We can pledge asset-backed and mortgage-backed securities, as well as FFELP Loans and Private Education

Loans, to the FRB as collateral for borrowings at the Window. Generally, collateral value is assigned based on the estimated

fair value of the pledged assets. At December 31, 2015 and December 31, 2014, the value of our pledged collateral at the FRB

totaled $1.7 billion and $1.4 billion, respectively. The interest rate charged to us is the discount rate set by the FRB. We did not

utilize this facility in the years ended December 31, 2015, 2014 and 2013.

On December 19, 2014, we closed on a $750.0 million ABCP Facility. Pursuant to FDIC safe harbor guidelines, we

retained a 5 percent or $37.5 million ownership interest in the ABCP Facility, resulting in $712.5 million of funds available for

us to draw under the ABCP Facility. On February 25, 2016, we amended and extended the maturity of the ABCP Facility. The

amended ABCP Facility extends the revolving period, during which we may borrow, repay and reborrow funds, until February

23, 2017. The scheduled amortization period, during which amounts outstanding under the ABCP Facility must be repaid, ends

on February 23, 2018. For additional information, see Notes to Consolidated Financial Statements, Note 24, “Subsequent

Event.”